One of the most exciting times for landlords is when you have secured a tenant, and they are ready to move in! Now begins the process of completing the lease, collecting the security deposit, and obtaining the first month’s rent. However, if you are not lucky enough to have tenants move in on the first of the month, how do you calculate the rent? In instances where tenants move later than the 1st, this partial month’s rent is called prorate. Continue reading below as we describe when to use it and the various ways to calculate prorated rent to make a move in, or move out, process a breeze!

What is Prorated Rent?

Prorated rent, also known as pro rata, is rent calculated proportionately. Meaning, if tenants do not begin their lease on the first of the month, the rent due is calculated by day based on the monthly rental rate.

Additionally, the same principle applies when a tenant moves out before the last day of the month. Also, if the tenant needs to stay a few days longer than the initial lease term, landlords may prorate the rent.

Ways to Calculate Prorated Rent

When it comes to how to calculate prorate rent, there are several ways owners can choose from. That said, all options rely on determining a percentage of the total monthly rent. Follow along with us below as we examine different ways to calculate prorate the rent.

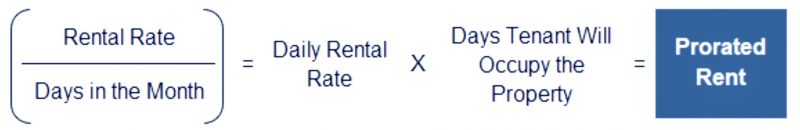

How to Calculate Prorated Rent Based on Days in the Month

To calculate prorate rent by the month, simply divide the rental rate by the number of days in the month. Then, multiply the daily rate by the number of days the tenant will occupy the property. Keep in mind, as the days in the month vary throughout the year, the prorated rent will also fluctuate. For example, tenants who move in on February 15th will pay more than someone who moves in on May 15th. Many landlords choose this method due to the fact it is easy to explain to tenants. Also, since the demand for rentals is higher in the summer, it is advantageous to calculate prorate rent by the month.

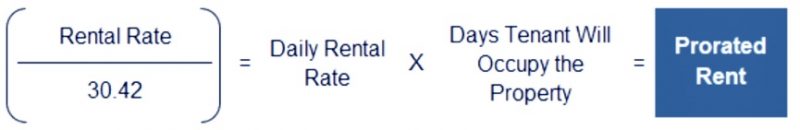

How to Calculate Prorated Rent Based on Average Days in the Month

This method is the same as above but instead allows landlords to average out the total days in a month throughout the year. So, since the average number of days in a month equals 30.42, landlords would divide the monthly rent by 30.42 to determine the daily rate. Then, multiply by the number of days the tenant will occupy the unit to get the prorated amount.

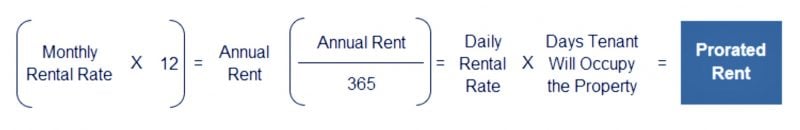

How to Calculate Prorated Rent Based on Days in the Year

Similar to how landlords calculate prorate rent based on the month, calculating based on the year is simple. So, start by multiplying the monthly rate by 12 to obtain the total annual rent. Then, divide that sum by 365, and this gives owners the daily rate per the lease. Once you calculate the daily rate, multiply this by the number of days the tenant will occupy the property in the prorated month.

When Does a Tenant Pay Prorate Rent?

As a landlord, being clear about your policies for prorated rent is critical. That said, a vital part of that policy must include when the prorated amount is due. Some landlords may require the first month’s rent in full regardless of when the tenant moves in. Especially if the landlord uses a realtor or professional management firm. In that case, the first month’s rent is typically paid as a leasing fee. So, if landlords do collect the full first month’s rent, a sample payment schedule would look similar to the one below –

-

March – Move-in March 15th with Security Deposit and 1st Months’ Rent Due in Full

-

April – Prorated Rent Amount from March is Due

-

May – Full Rent Due

-

June – Full Rent Due … and so on

Communication with tenants is key. This avoids issues at move-in and building a stable landlord-tenant relationship. So, once a landlord approves a tenant’s application, provide tenants with a list of all charges due at move-in. Furthermore, take time to answer any questions they may have so there is no confusion at move-in.

Best Practices for Calculating Prorate Rent

There are benefits to each method of prorating calculation. However, developing best practices and staying consistent is the key to success.

- Establish Prorate Policies – When a tenant’s lease begins on the first, but their move is a different day through no fault of the landlord, owners are not expected to prorate the rent. While this may be common practice, it should still be in writing. Another key policy to address is whether or not landlords will prorate the rent at move out. Whatever your policies may be, they must be in writing and consistent amongst every tenant. This is vital to avoiding Fair Housing discrimination claims.

- Prorate Practices in the Lease – A prorate clause in the lease is the best way for landlords and tenants to agree on terms. The lease must state exactly what the tenants owe based on when they move in, whether you choose to prorate or not. It is a good idea to check your figures using an online prorated rent calculator or trusted formula. However, if you opt not to collect prorated rent, make sure this decision complies with local law.

The Stress-free Way to Handle Leasing and Prorating Rent

How to calculate prorate rent procedures are just one part of owning a rental property business. When it comes to efficiently marketing, leasing, and managing maintenance issues, there is no better support than partnering with a professional property management company.

The dedicated team at Bay Property Management Group can handle the entire leasing process, including calculating and communicating prorate rent policies to tenants. Give us a call today to find out more about what full-service property management can bring to your portfolio!