If you plan on buying a property in an HOA community, it’s crucial to understand any fees or dues you’ll have to pay while owning a home there. While no two associations are the same, most generally have HOA assessments and other fees you’ll have to pay. But what’s the difference between the two? Today, we’ll go over HOA assessments, what they cover, and other fees to know about before buying a property in an HOA community.

Contents of This Article:

- What are HOA Assessments, and What Do They Cover?

- Why Do HOAs Charge Special Assessments?

- What are HOA Fees, and What Do They Cover?

- Can You Get Out of Paying HOA Fees?

- Why Choose BMG For Your HOA Management?

What are HOA Assessments, and What Do They Cover?

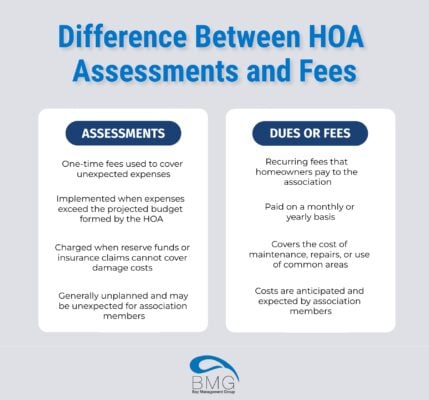

When you’re part of a homeowners association, you can expect to pay regular fees, dues, and occasional assessments. While many people assume that HOA assessments and HOA dues are the same thing, the two terms are completely different. Dues are regular, recurring fees homeowners agree to while buying property within an HOA.

HOA assessments, or special assessments, are one-time fees that an association charges when unanticipated expenses arise. Generally, at the start of each year, an HOA board will prepare a budget to help determine how much they’ll charge each homeowner in monthly dues. However, the projections may be inaccurate, resulting in a shortage of funds for the year.

As such, to cover the additional costs, the board can charge special assessments. For instance, unexpected expenses or emergencies may call for the collection of HOA special assessments. Next, we’ll go over some of the reasons HOAs may charge special assessments.

Why Do HOAs Charge Special Assessments?

Special assessments are usually a last resort for HOAs. Homeowners associations should have a solid reserve fund with enough money to cover unexpected costs along with major repairs or replacements. However, if the reserve funds run out, that’s where HOA assessments come into play.

So, if a disaster occurs that affects the community, the HOA would file an insurance claim and take care of the costs through their provider. However, if the HOA’s insurance doesn’t cover the cost of the expenses, it may need to outsource and charge members special assessments.

For instance, if the HOA needs $15,000 to pay for uninsured damages, they will split the costs among all the association members. However, each association splits the charges differently according to their HOA special assessment rules. So, refer to your association’s governing documents to learn how they divide up assessments.

What are HOA Fees, and What Do They Cover?

HOA fees, otherwise known as dues, are recurring fees that homeowners pay to the association. Unlike special assessments, which are one-time payments, HOA dues are paid regularly. Typically, homeowners pay these dues or fees on a monthly or yearly basis.

The HOA board is responsible for calculating the dues and fees for each fiscal year. It starts with budget preparation, where board members anticipate the cost for each necessary expense. For instance, they take into consideration vendors, management fees, utilities, landscaping, and other expenses.

HOAs use these regular dues to cover the costs of maintenance, repairs, and other expenses to help maintain the community’s common areas. Essentially, HOA dues cover the operating expenses of the community and contribute to a reserve fund.

Can You Get Out of Paying HOA Fees?

Unfortunately, you cannot get out of paying HOA fees, dues, or assessments. These fees are mandatory and something that homeowners consent to when purchasing their first property. That said, if you default on your dues or assessments, the HOA can force compensation using a number of methods, including the following.

- Late Fees- If you miss an HOA payment, you’ll receive a notice and a late fee, typically giving you 30 days to pay before the fine increases.

- Revoke Privileges- In some cases, your HOA can suspend your rights and privileges as a consequence of nonpayment. This may include your right to vote on association matters or access to community amenities.

- Legal Action- Failing to pay an assessment or fee can lead to your HOA filing a lawsuit to force payment.

- Attach a Lien- Failure to pay HOA fees or assessments can result in the association putting a lien on your property. Continuous failure to pay can make it harder to sell your property, as the lien will appear in a title search.

- Foreclosure- An HOA can eventually foreclose on a home if the owner continuously fails to pay the required fees and assessments.

Why Choose BMG For Your HOA Management?

Understanding HOA assessments and fees is crucial if you plan on buying a property within an HOA community. Knowing these additional costs and fees can help you budget and prepare accordingly. Additionally, it can help you make a decision on whether or not owning properties within an HOA community is right for you.

Need More Advice? contact us today!

If you own properties within an HOA community and need help managing them, look no further than Bay Property Management Group. Our expert team offers top-notch service to handle all of your Philadelphia homeowner’s association management needs. We provide a dedicated portfolio manager and customer service team, help coordinate meetings, prepare budgets, and so much more. Contact BMG today to learn more about our HOA management services.