The most important factor driving rental investment is the real estate market. Buyers and sellers alike wonder how COVID-19 will continue to affect the real estate market as we head into 2021. Are you looking to sell a rental property? Is now a good time to invest in real estate? Before deciding your next move, it is important to understand the difference between a buyer’s and sellers’ markets. Below we break down the 2020-2021 real estate market outlook along with how COVID will affect interest rates, approvals, inventory, and the rental market. Read on to find out more.

What is the Difference Between Buyers and Sellers’ Market?

A market offering more supply than demand is considered a buyers’ market. So, this means that the wide selection that buyers have to choose from works against a seller. Therefore, sellers may have to accept a lower offer or take additional steps to make their listing more appealing than the competition. This is a great scenario for those looking to buy because you can score a great deal.

On the flip side, sellers benefit from low inventory and high demand. These situations often lead to multiple buyers bidding on one property, which can drive prices higher. So, great for sellers, but not necessarily buyers since they will need to pay more to get what they want.

What is the Outlook for the 2021 Real Estate Market?

Several factors go into predicting real estate trends. As 2020 winds down, the upcoming election, continuing COVID-19 pandemic, and individual financial concerns will continue to affect the market in 2021. When COVID began, home sales dropped while many listings were pulled from the market altogether due to the uncertainty. Any seller who remained on the market was considered motivated, thus giving buyers a brief upper hand. However, the tides are shifting. Let’s take a look at some current data as of September 2020 according to Realtor.com:

- Median List Price – $350,000, which is up 11% year over year

- Days on Market – 54 days, which is down 18% year over year

- Active Listings – 828,576, a figure which is down 39% year over year

A Strong Seller’s Market

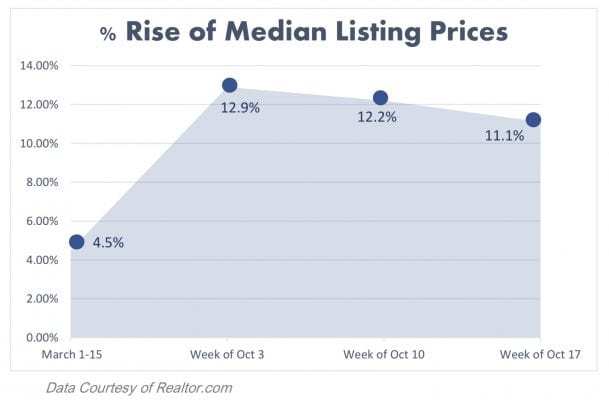

Now, why are these numbers important? Well, according to Realtor.com, although inventory is lower than in previous years, there is a steady upward trend. Additionally, prices are climbing with more than 10 weeks showing a steady price climb. Additionally, homes are selling faster, which is an ideal situation for sellers looking to sell fast and for top dollar.

High Prices Mitigated by Interest Rates

As prices climb, some buyers may struggle to meet the financial demand. Thankfully though, interest rates remain low as COVID-19 forced officials to mitigate the negative impact the pandemic has had on the economy. It is these low rates that now, in part, drive the demand for home sales. The pandemic initially halted the market, but as the economy continues to open, demand is increasing. That combination of low inventory and swelling demand creates a hot seller’s market that experts expect to continue into 2021.

No one disagrees that the remainder of 2020 leaves many questions; however, rates will continue an appealing low trend. If the Fannie Mae forecast is correct, predicting rates could fall even lower to 2.9%, demand for properties will only increase. That said, much is left up in the air as the country waits to solve the COVID-19 pandemic. If a vaccine is introduced and the economy continues to bounce back, rates may begin to rise. However, it is just too early to tell.

Is a Balance Between Buyers and Sellers Coming?

Not now, at least. Inventory remains low with no viable evidence that the supply will meet the demand, both current and expected. New home development, which had been strong throughout the Summer, also shifted down in August. Low supply is expected throughout the remainder of Quarter 4 with little hope 2021 will see the increase needed to shift the market seller to buyer-friendly. Steady rising prices also signal a seller’s market.

Will Real Estate Prices Continue Rising in 2021?

Yes. Zillow’s Housing Market Forecast predicts the market will continue seeing prices above pre-pandemic levels. According to Zillow’s models, the market may see an increase in property appreciation values by as high as 4.8% between now and August of 2021.

The election also plays a key role in the fate of the real estate market. As uncertainty regarding changes to policies and real estate taxes weighs on everyone’s mind, some buyers choose to delay purchasing. Historically, however, after an election, the market sees an influx of demand as buyers regain confidence.

Seller’s Market Key Takeaways

The upcoming year is set up to be a seller’s market, giving homeowners an edge with negotiating prices. Let’s recap a few key takeaways that may impact your decision to buy or sell in 2021.

- Inventory is low and will remain lower than the demand

- Mortgage rates are expected to remain low

- Real estate demand is on the rise due to many factors

- Home prices throughout 2021 will see strong gains

Is it a Good Idea to Invest in Real Estate During a Seller’s Market?

The predictions may say it will not be a buyer’s market anytime soon, but that does not mean investors cannot buy. It does, however, mean looking for that great deal may take more legwork than anticipated. An important thing to remember is that the real estate market varies from state to state, city to city, and even town to town. So, take the time to do your research and think outside the box. Below are a few tips investors can use to buy in a seller-friendly market.

- Ditch Your Boundaries

- Analyze, Analyze, Then Analyze Some More

- Enlist Professionals

- Be Prepared and Aggressive

Ditch Your Boundaries

As an investor, you may need to venture outside of your local market to find the best deals. While the US is a seller’s market, that does not mean every location shows the same metrics. Now is the time to be bold and seek new markets that may prove profitable in the long run. That said, working in unfamiliar areas means you need to be hyper-vigilant in researching local comps and projected rental income to ensure viability.

Analyze, Analyze, Then Analyze Some More

Savvy investors know it all comes down to numbers. In a market where margins are tighter than ever, ROI is vital. Thoroughly evaluate current rental market conditions, average prices, and job growth in the area. Once all is considered, come into a deal, knowing exactly the margins you need to meet to be profitable.

Enlist Professionals

A sellers’ market means demand is high. With deals flying off the market faster and faster, investors need a competitive edge. Where better to get that edge than with a real estate agent? Seek out the assistance of an experienced real estate professional to help you find, negotiate, and close the deal!

Be Prepared and Aggressive

Investing in real estate is not the same as buying an owner-occupied forever home. Investing is where numbers trump emotion, and investors must react quickly. Do your research and know your budget, so when a deal presents itself, you are prepared. In such a competitive market, even a slight hesitation could see you missing out. Now is not the time for a low ball or unrealistic offers. So, make reasonable offers that fit within your budget and ROI needs. If the numbers do not add up, do not be afraid to move on.

Rental Housing Outlook for 2021

COVID-19 is not just affecting the real estate market, but the rental market as well. Demand for a home purchase may be growing, but so are prices. This rise in price, along with financial uncertainty, the COVID pandemic has created, will drive the rental market into 2021. However, many factors, once seen as vital in determining rental growth, have shifted amid the pandemic era. Take a look at some things to consider regarding the rental market outlook for 2021.

- Going Virtual

- Location, Location! Maybe Not?

- Affordability continues to be an Issue

- More Space, More Value

Going Virtual

Social distancing and restrictions may have already forced landlords into a virtual world. However, that is likely here to stay. The COVID necessity of things such as no contact virtual tours, digital forms/lease completion, and online rent collection has now become a welcome convenience to many renters. Some apartment complexes have gone as far as to offer virtual workouts, mixology classes, yoga instruction, or Zoom social events.

Location, Location! Maybe Not?

Relocating for a job is not a foreign concept to many renters. That said, the pandemic has proven many jobs are completed just as efficiently from home. Essentially, this means an employee can be located anywhere and still do the same job. As we head into 2021, the rental market will see less migration than in previous years. Local markets, once known as being tech hubs, are seeing a decline in rent prices and increased vacancy rates.

Affordability Continues to be an Issue

As individuals struggle with financial uncertainty and lost jobs amid the continuing pandemic, affordable housing demand is high. However, most areas around the country are not prepared to meet this demand. In an effort to fill a vacancy, landlords may find themselves having to lower rates, offer incentives, or provide free services to draw people in.

More Space, More Value

More of the workforce than ever are working from home while kids are still in distant learning throughout many states. These factors create an inevitable need for more space. Renters are searching for larger spaces with room to separate work life from home life. That said, renters are still looking for value, and added space does not automatically equal exorbitant rates for landlords.

Final Thoughts

As investors, buyers, and sellers continue to navigate the uncertainty that COVID-19 brings, several things are clear. A seller’s real estate market is what awaits us in 2021, where demand is high and inventory remains low. Navigating such circumstances can prove troubling and stressful to landlords. After the freeze on evictions and rent increases, you may wonder how you can create a profitable rental once again. Bay Property Management Group is here to help. We are ingrained in the local communities, keeping up with all federal, state, and local requirements that COVID-19 has created. Our experienced staff can seamlessly step in and guide you to the light at the end of the tunnel, no matter your situation. Reach out to one of our dedicated team members to learn more about our comprehensive property management services in Harford County and throughout Maryland, DC, Pennsylvania, and Virginia.