The real estate industry, like many others, seems to have its own language and lingo. Working knowledge of common real estate investment terms will help you absorb vital information quicker. It will aid you in communication with those already in the industry. So, join us below as we define some common real estate lingo and acronyms to have you using them in no time!

Knowledge is power, and part of that power is knowing the terminology. Understanding standard terms will aid investors in navigating both listings and negotiations. Let’s look at some common real estate lingo and acronyms.

Seller’s Market – A seller’s market typically sees higher prices and more buyer competition. This occurs because the demand for available properties far outweighs the supply on the market.

Seller’s Market – A seller’s market typically sees higher prices and more buyer competition. This occurs because the demand for available properties far outweighs the supply on the market.- Buyer’s Market – Unlike a seller’s market, buyer’s markets see lower prices and plenty of inventory to choose from.

- Single-Family Property – A single-family home is a residential property that does not share walls and is not attached to any other structures.

- Multi-Family Property – Multi-family dwellings house several different families in separate units. Some examples include apartment buildings and duplexes.

- Real Estate Agent – Real estate agents are professionals licensed to represent parties during a real estate transaction. Once they have obtained a license, real estate agents work under the supervision of a broker.

- Realtor – A realtor is an estate agent with the important distinction of belonging to the National Association of Realtors. In addition to abiding by all local and state laws, realtors must also follow the association’s standards and ethics.

- Real Estate Broker – A broker is a licensed professional who can represent parties during transactions. The main difference is a broker may work independently, while a realtor or real estate agent must work under a broker.

- Pre-Approval Letter – The pre-approval is an important step. This letter from your lender should come before looking for a property and applying. Thus, this determines how much you can afford.

Real Estate Terms Every Rental Investor Should Know

- Home Equity – This term refers to the difference in the present market value and the amount still owed on the mortgage. Over time, equity will grow as the market appreciates and the mortgage balance decreases.

- Debt-to-Income Ratio – Lenders use a debt-to-income ratio to evaluate an individual’s ability to repay monthly debts. It compares outstanding debt to a buyer’s gross income.

- Cash Flow – This is an important metric for real estate investors. It measures the amount of profits an investor banks after any outgoing expenses.

- Appreciation – Due to increased demand, low supply, or inflation, appreciation accounts for a property’s increase in value over time.

- Predictive Analytics – Predictive analytics provides real estate investors with a reliable outlook of future returns based on historical data.

- Hard Money Loan – Offering faster processing but higher rates, a hard money loan bases itself on an investor or organization’s assets.

- Net Operating Income – Net operating income equals the annual income left over after deducting taxes, fees, and utilities.

- Cash on Cash Return – This is the ratio, expressed as a percentage, of annual cash flow before taxes against the total cash invested.

- Capitalization or Cap Rate – The capitalization rate references the ratio of net operating income produced to its capital cost or market value.

- Rental Property Calculator – An online tool investors can utilize to help determine a rental property’s return on investment, cash flow, and cap rate. If you are looking for a great online rental property calculator, check out the one from Zillow.

- Property Management – Many investors that own several rental properties hire property management in Washington, DC, to handle tenant communications, property listings, maintenance, and more.

Helpful Real Estate Lingo and Acronyms for Investors

In addition to industry-specific terms, acronyms are commonly used in both real estate transactions and listings. Knowing what they mean and how to use them to your advantage gives savvy investors an edge in the competitive market.

So, let’s spell out exactly what these common real estate lingo and acronyms mean and why they are important.

- MLS or Multiple Listing Service

- FSBO or For Sale by Owner

- PITI or Principal, Interest, Taxes, and Insurance

- ROI or Return on Investment

- GRI or Gross Rental Income

- FMV or Fair Market Value

- LTV or Loan-to-Value

MLS or Multiple Listing Service

There are more than 800 MLS services across the United States. This is an offer by real estate brokers of cooperation and compensation to other real estate agents. Unfortunately, not all properties on the market are available through one of the MLS lists.

Additionally, only licensed agents and members of a real estate association can list properties on the MLS. This is important for investors because working with individuals accredited by the National Association of REALTORS® means they have a higher standard of ethics.

When you are purchasing an investment property, proper and honest representation of the property’s condition is key in these transactions. Therefore, who you work with is very important.

FSBO or For Sale by Owner

This term describes an owner who is selling their property without using a real estate agent. Several scenarios can lead to an owner choosing to go it alone; they may not feel the need for an agent when the market is hot, or they may not be able to afford the commissions if they have little equity built up. Either way, this is a listing type that can appeal to investors.

If the savings from not paying commission can pass to the buyer, it’s a win-win. Keep in mind, though, properties not listed through an agent can open buyers up to a certain amount of risk. Investors should be wary and do extra due diligence since, unlike agents, private owners are not held to a standard of ethics. That said, an FSBO home could present your next big deal!

PITI or Principal, Interest, Taxes, and Insurance

This acronym is short for a mortgage payment that includes the principal, interest, taxes, and insurance. It provides a full picture of these expenses expressed as one value, which investors can use when added to operating expenses to evaluate cash flow.

Many investors forget insurance premiums and taxes in their calculations, which provides an inaccurate picture of a property’s profit potential. When evaluating financials for future purchases, do not forget any of the monthly expenses and consider lumping PITI into one sum.

ROI or Return on Investment

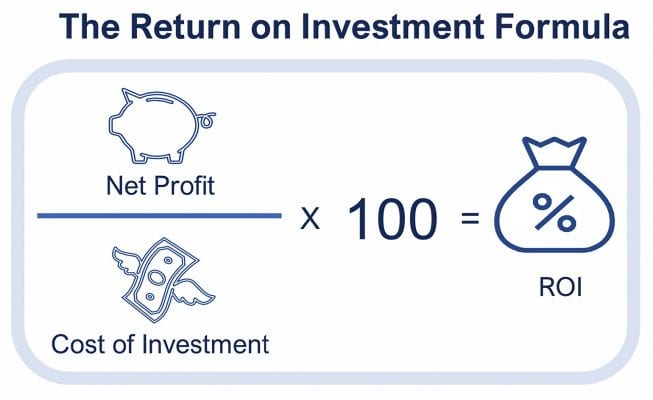

ROI is a popular term for an equation that calculates the percentage value of an investment’s profitability. The calculation is simple; (Net Profit/Cost of Investment) X 100 = Percentage Value or ROI.

So, if the return on investment results is positive, a property is worthwhile. On the other hand, negative ROI signals net loss, which is a bad sign for investors. Real estate investors should aim for an ROI of around 10 to 12%.

GRI or Gross Rental Income

Gross Rental Income is the amount of rent collected plus any fees or expenses paid from tenant to landlord. However, refundable security deposits paid by the tenant are the exception. Since these may need to be returned to the tenant, they are not considered income.

Investors use GRI to forecast the total amount of potential income a particular property could generate. In addition, investors can estimate adjusted gross income by using the GRI and then deducting expenses. These types of calculations are helpful when determining where and which property to invest in.

FMV or Fair Market Value

Fair Market Value represents the reasonable price a property would sell for in an open market. An open market refers to when both the buyer and seller are free from pressure, and both parties are knowledgeable. So, this is vital for any buyer, especially investors, as it determines if you are getting a good property price.

Investors can opt to use a third-party appraiser, a real estate agent, or a broker price opinion to determine FMV. Remember, FMV is not the same as the appraised value used for tax purposes.

LTV or Loan-to-Value

By definition, LTV is a percent measuring the total property debt compared to market value. This is an instance where lower is better regarding investment properties. Lower LTV means less of a risk for investors to become “upside-down” or have negative equity.

A lower mortgage payment allows investors to allocate more monthly income to establish a financial cushion. Generally, an LTV of around 75% is conservative; if you can get that percentage even lower, that is a huge plus!

Don’t Forget About Property Management

Property investment takes due diligence, careful calculation, and a willingness to immerse yourself in the industry. Learning real estate lingo and acronyms is the first step. Are you an investor who needs time to look for your next big deal? A professional rental property management company could be just what you need!

At Bay Property Management Group Carroll, we understand the challenges investors face. As a company led by a real estate broker with their own investments, our focus is on full-service rental management for a stress-free owner experience.

Seller’s Market – A seller’s market typically sees higher prices and more buyer competition. This occurs because the demand for available properties far outweighs the supply on the market.

Seller’s Market – A seller’s market typically sees higher prices and more buyer competition. This occurs because the demand for available properties far outweighs the supply on the market.