Calling all fans of a good fixer-upper! If you are looking to purchase a rental property that needs a little extra TLC and have noticed that the lenders become stricter with approvals, you are not alone. In addition to a large down payment, exceptional credit, and all of the other hoops you must pass through for a loan approval, you must have enough cash left over to make home improvements in order to make a fixer-upper appealing. Therefore, investing in a fixer-upper rental property becomes problematic, even for a seasoned property owner. So, after meeting all of the criteria to get the loan, there is still the issue of having enough capital to cover the cost of renovations. While there are plenty of creative ways to finance a rental property, if you are looking to purchase a residential rental property that requires renovation, consider a 203(k) loan. Join us below as we take a look at how a 203(k) loan works, its limitations, and important rules so you can decide if this option is right for you.

What is a 203(k) Loan?

An FHA 203(k) loan allows you to borrow money for a property purchase as well as home improvements. In other words, this type of loan finances both the cost of the property and the amount needed to fix it up, all in one mortgage.

Guaranteed by the FHA, this loan is less of a risk to lenders than other types of loans. With the lower risk level, you are more likely to be approved and with a lower interest rate than traditional bank loans. In fact, some 203(k) loan interest rates can be as low as 3.5%.

In addition, using a 203(k) loan will give you quick and efficient access to the much-needed cash you will need to pay for repairs, renovations, and improvements on your fixer-upper rental.

Types of 203(k) Loan Programs

Two loan types fall under an FHA 203(k) loan program. Which one you need will depend on the cost to purchase the property and the estimated cost to repair your new rental. Check out the details of these two options below.

Standard 203(k) Program

This loan is best for properties that need extensive repairs, including major additions and structural changes to the property. The limitation is you cannot add anything that is not permanent. Keep in mind, luxury items that do not become a part of the real property—such as BBQ pits, exterior hot tubs, swimming pools, tennis courts, and satellite dishes—are ineligible for repair under a 203(k) loan. Take a look at the stipulations for the standard loan:

General Provisions of an FHA Standard 203(k) Loan

- Allows for a loan amounting to 110% of the after-improvement value determined by an appraisal

- A 203(k) consultant must conduct a thorough property inspection

- A minimum of $5,000 must be borrowed for repairs

- All other guidelines are similar to FHA standards

What is Not Allowed Under an FHA Standard 203(k) Loan?

- Landscaping

- Adding luxury amenities

- Any projects that will take longer than 6 months

Limited 203(k) – (formerly Streamline 203(k) Program)

This loan is ideal for properties that require repairs that will cost less than $35,000. Keep in mind that most FHA 203(k) loans require a 15% buffer on the total remodeling bids. This protects you and the bank from unexpected overages during the remodeling process and ensures costs do not exceed the loan amount.

Under a Limited 203(k), an owner can complete cosmetic improvements that will not affect the property’s structure or do not include an addition. Furthermore, a limited 203(k) loan has the added benefit of being offered by a wider variety of lenders and tends to be a simpler process than its standard counterpart.

Repairs Allowed with an FHA Limited 203(k) Loan

- Kitchen remodels

- Bathroom upgrades

- New Appliances

- Carpet and flooring

- Roof repairs or replacement

- Painting

- Addressing safety and health issues

- Energy-efficient improvements

- Anything else that does not affect the structure or footprint, or is considered a luxury item

What is the Process for an FHA 203(K) Loan?

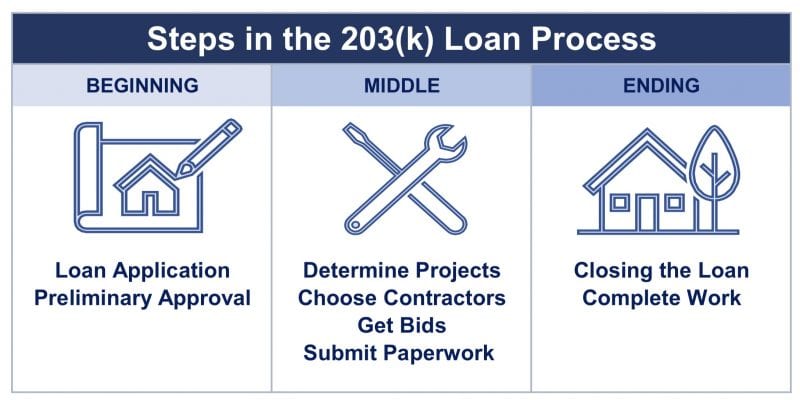

Generally speaking, the process is not unlike other loan options for buying. However, there are a few extra steps that need to be completed before purchase. Keep in mind that this process does typically take longer than a traditional mortgage loan. Follow along with us as we outline the steps below.

Steps in the 203(k) Loan Process

- Loan Application

- Receive Approval

- Determine Projects

- Choose Contractors

- Get Bids

- Submit Paperwork to Lender

- Closing the Loan

- Complete Work

Loan Application

It all starts with an application detailing your personal assets, income, and credit. Lenders will take all of this information into account before issuing a preliminary approval. However, before applying for this type of loan, do your research as not all lenders offer the FHA 203(k) as an option.

Receive Approval

Once you have applied for the loan, you receive preliminary approval, and the real work begins. Below we detail the next several steps in the process on the way to final approval and closing. While obtaining final approval involves many moving parts, the loan officer will walk you through the individual requirements and deadlines.

Determine Projects

Deciding what projects need to be completed is an important step. All health and safety issues must be remedied first, followed by any cosmetic items. Whether the home needs a gut renovation or just some updated appliances, all of these items can be worked into your remodel plan.

Choose Contractors

Ok, the project list is complete, and now comes the time to find someone to complete the work. The lender will require all potential contractors to be fully insured and licensed. This is not the time for a friend of a friend who does some handyman work on the side; the bank will not allow it. Renovations under this loan can only take up to 6 months to complete; therefore, seek out contractors with experience in these endeavors.

Get Bids

With a shortlist of contractors in hand, have them submit a detailed and official bid for the job at hand. Ensure these bids are accurate since the lender will be submitting them to the appraiser. The appraiser will use the projected work to be complete as part of their process in determining future value.

Submit Paperwork to Lender

Once you have obtained all of the required bids, this paperwork can join your personal income and credit information to go for final approval. After all paperwork has been verified and reviewed, you should receive the go-ahead for closing. You are now one step closer to your fixer-upper rental income property!

Close the Loan

Just as in a traditional mortgage, closing includes signing all final documentation. Once complete, the home is yours, and remodeling work can begin congratulations!

Complete Work

After closing and getting the keys, the clock is ticking to complete any renovations. If the home is vacant, this makes the contractor’s job easier, but you must monitor their progress and ensure it is on track to be completed within the allowed timeframe. Additionally, be prepared for periodic lender inspections along the way.

What Improvements Can You Make?

Since this loan helps investors improve their properties for occupancy, it is important to understand the eligible repairs you can make with the loan money you receive. Below is an overview of the types of home improvements covered.

Types of Improvements Under a 203(k) Loan

- Roof replacement or repair

- Replacement, repair, or upgrade of HVAC system

- Repair or replacement of plumbing

- Full interior or exterior painting

- Replacement of old windows

- Appliance replacement

- Attic finishing

- Replacement or repair of deck, patio, or porch

- Bathroom remodeling

- Landscaping such as tree removal, driveway/sidewalk repair, or grading correction

What Are the Rules of a 203(k) Loan?

Since 203(k) loans are a unique kind of loan, there are specific regulations you must follow upon loan approval. Here are some of the things you can do with a 203(k) loan:

What Can You Do With a 203(k) Loan?

- Purchase a Fixer-upper: 203(k) loans are designed for properties that need improvements or remodeling. Since banks will not typically finance a house that is run-down, a 203(k) loan is a great way to invest in that rental property you know is a diamond in the rough.

- Do the Work Yourself: If you can prove you have the ability to do your own remodeling and can finish within the 6-month timeframe, you can use your 203(k) loan money to do so. However, you can only use the money on supplies. Since you are performing the work yourself, you cannot pay yourself as a hired contractor.

- Expect Multiple Inspections: An inspector will inspect your property’s progress throughout the 6-month time period. This is why your contractor must be reliable—he must start working on the home within 30 days and cannot stop work for longer than 30 days. In addition, there is that ever-looming 6-month timeline.

- Use the Loan Money to Make the Mortgage: You are able to do this even if you cannot yet occupy the property; you can use the loan to pay for up to 6 months of principle, interest, insurance, and taxes. This is the beauty of having a two-for-one loan.

- Upgrade to be Energy Efficient: You can get approval for a 203(k) loan to upgrade your rental home to be energy efficient. An added bonus is that these improvements do not require an appraisal.

- Make Mini-Renovations: If you invest in a rental that needs a minor renovation such as a new kitchen, bathroom, or room addition, you may qualify for the streamlined 203(k) loan mentioned above. This is assuming the improvements fall within the eligible repair limitations and cost under $35,000.

- Start Over: With a 203(k) loan, you can tear down the entire property and build up again, so long as you keep the foundation in place, and again, make the deadline.

What Can You Not Do With a 203(k) Loan?

- Invest in New Construction: The home you are looking to remodel with 203(k) loan money must be at least one year old.

- Make Repairs Under the $5,000 Minimum: You must spend at least $5,000 of your 203(k) loan on renovations. This means you cannot replace one or two appliances and pocket the rest for mortgage payments.

- Break Any 203(k) Loan Rules: You can trust that your 203(k) loan lender will hold you accountable to all of the stipulations such a unique loan has. He will be involved in every step of your property’s renovations and in the end, you can bet to find yourself in a lot of trouble if you violate any of the loan provisions.

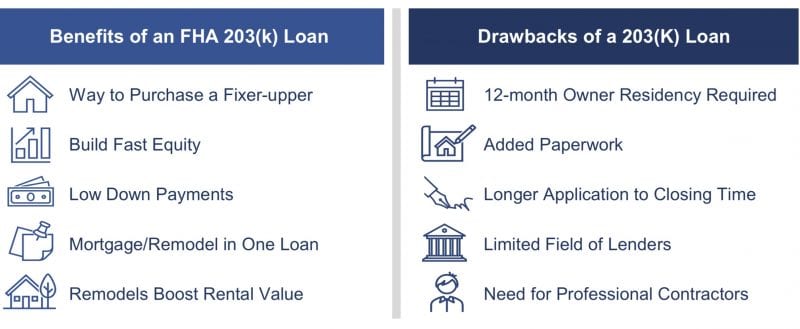

What are the Cons of a 203(k) Loan?

Now that you have a clear idea of what a 203(k) loan is all about, it is time to consider the drawbacks. In order to prevent rental property investors from using 203(k) loans to build their portfolios quickly and efficiently, and thus avoiding the hardships many lenders pose as portfolios grow, investors are not allowed to use 203(k) loans to finance their rental properties. Those looking to utilize a 203(k) loan must occupy the property themselves for a minimum of 12 months unless you are a qualified non-profit organization. That said, a 203(k) loan can still be an excellent opportunity to buy a property, enjoy it for a while, and then turn it into a rental property after the 12-month minimum residency.

Drawbacks of a 203(K) Loan Include:

- 12-month owner residency required

- Added paperwork

- Longer application to closing times

- Limited field of lenders

- Need for professional contractors

However, if you are looking to turn your primary residence into an investment property, a 203(k) loan is worth looking in to. Though there are some restrictions in place, this type of loan can be a great way to get all-in-one financing, remodel your property for additional value, and get it into the rental property market looking great.

What are the Benefits of a 203(k) Loan?

There might be a few more hoops to jump through, but an FHA 203(k) loan is worth the effort to the savvy investor looking at long term goals. Before deciding if this is the best choice for you, take a look at the benefits below.

Benefits of an FHA 203(k) Loan

- Excellent (sometimes only) way to purchase a fixer-upper

- Build fast equity

- Low down payments

- Bundles mortgage and remodel cost into one loan

- Remodeled homes boost the rental value

So, if you are willing to battle through the added paperwork needed, a 203(k) loan might pay off big in the long run.

Final Thoughts

An investor that uses the FHA 203(k) loan process for their rental property investments is clearly in it to win it. So, after you have the properties and are ready to rent, how can you ensure the best return on investment? Simple, hire a qualified and local Philadelphia property management expert. Bay Property Management Group Philadelphia has experience as both investors and property managers. Our dedicated staff builds on their industry and market knowledge to guide you to a profitable rental experience. From leasing to routine maintenance and beyond, we have it covered. Contact Bay Management Group today to see what Bay Property Management Group can maximize your ROI.