It’s now been over 9 months since the coronavirus initially began to spread throughout the United States, and although many Americans have been able to avoid getting sick themselves, every single person has been affected by COVID-19 in one way or another.

One of the largest side effects being the drastic changes to our economy & various markets. With more than 11 million people still unemployed and many businesses having to close their doors, the economy has no doubt taken a hit. But what about the real estate market?

We Analyzed Over 4,000 Homes in the Baltimore, Philadelphia, & D.C. Areas and Here’s What We Found:

As a property management company, the entire team here at Bay Property Management Group no doubt keeps a keen eye on the real estate market as well as the rental market as a whole. Thus, we set out to study just how drastically this pandemic has affected both real estate & rental markets so that property owners can stay informed, & protect their investments despite COVID-19.

Due to the Coronavirus pandemic, many states have/had enacted various changes or laws that may seriously affect homeowners & landlords, such as:

- Eviction Moratoriums (A pause on the legal right to evict tenants for non-payment if caused by the coronavirus pandemic)

- Temporary Waiver Of Late Fees

- Repayment Agreements (Although evictions may be paused, rent is still due and must be repaid to the landlord)

- Illegal Lockout Lawsuits (If a landlord illegally locks out a tenant without first going through the court systems, the landlord could be sued).

- Much more…

These changes have caused many landlords to fear how they themselves will be able to make their mortgage payments, and keep their investment properties safe and secure during the pandemic.

Temporary Halt in Residential Evictions

Before the coronavirus, Maryland was ranked as the state with the 10th highest eviction rate in the country at 3.6%. However, due to the pandemic an eviction moratorium was put into effect that protected tenants affected by the coronavirus from being evicted for non-payment. This has been a helpful provision for many renters in the Baltimore area who have been financially affected by COVID-19.

However, the moratorium does not mean that a renter no longer has to pay rent, the rent is still due and must be repaid to the landlord.

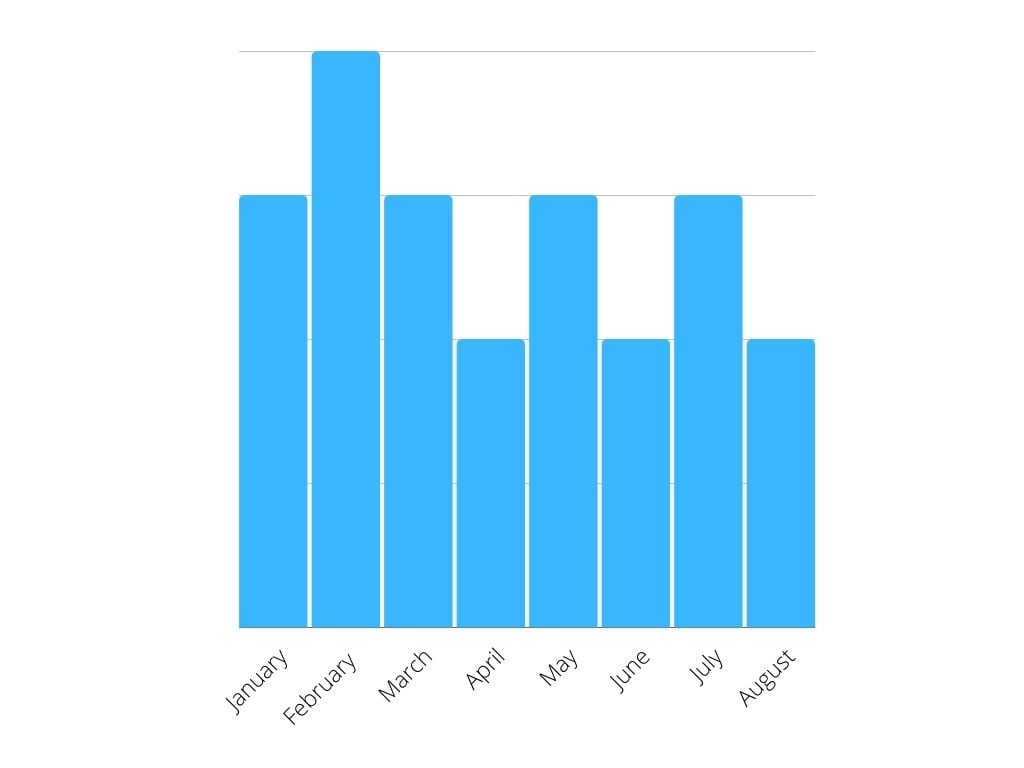

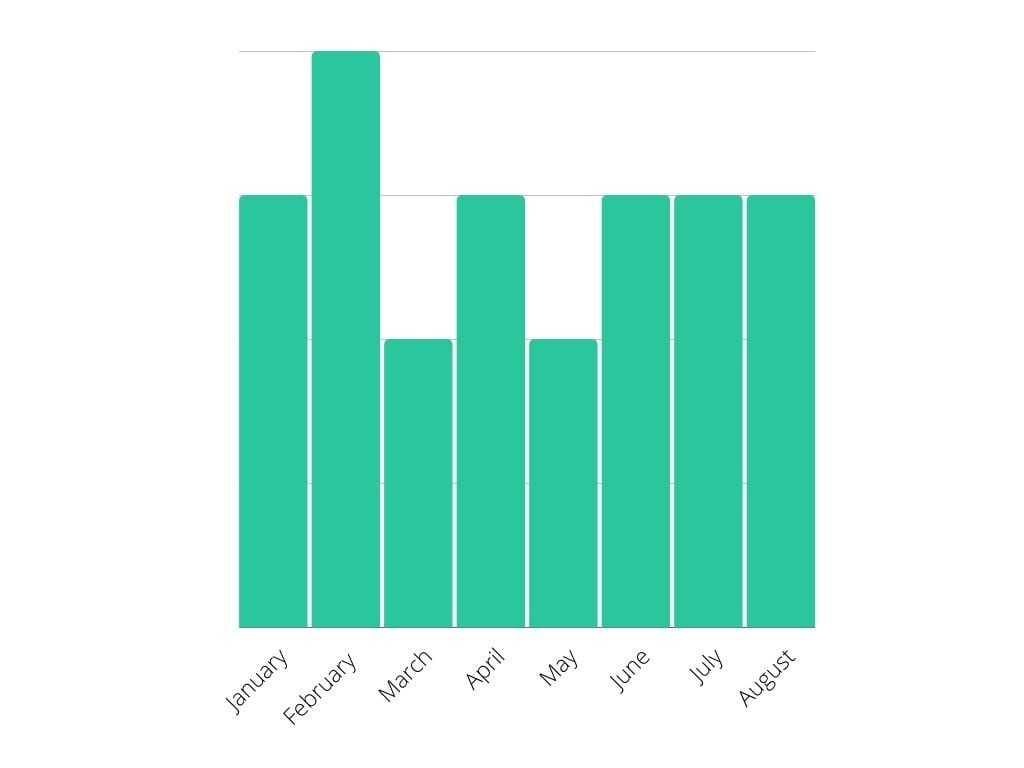

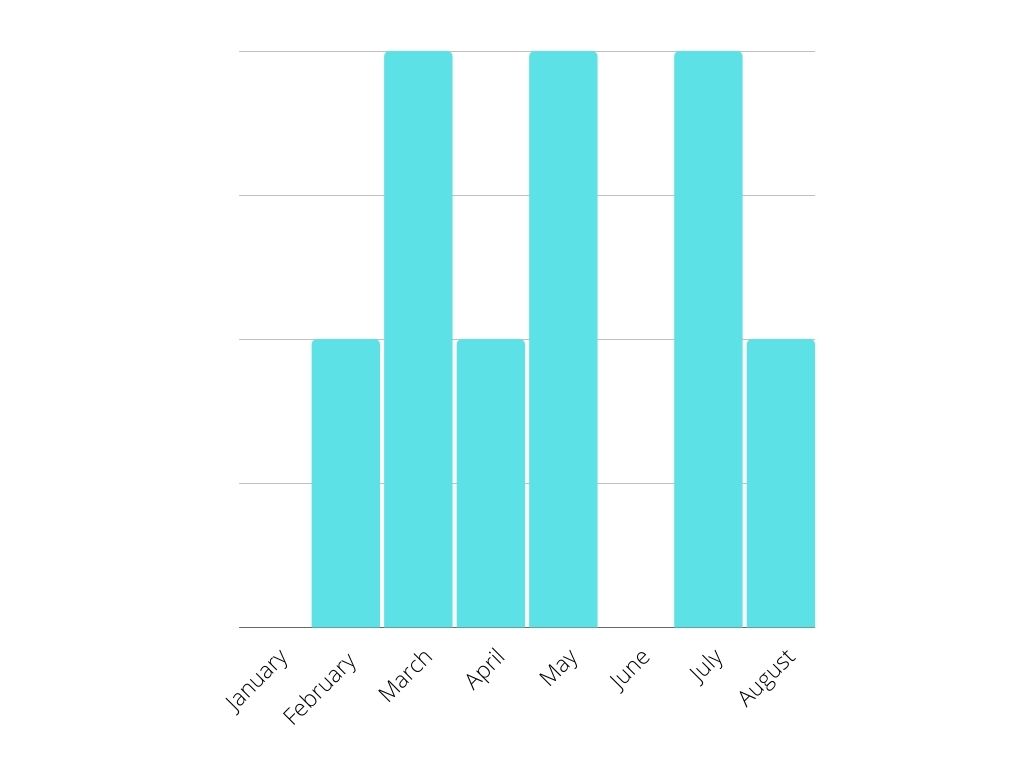

Thankfully, due to our detailed process for qualifying potential renters, even before the pandemic the team here at Bay Property Management Group only had a monthly eviction rate of 0.2% or less. Meaning you could often count our total number of evictions on one hand on any given month. This is because as a property management company, protecting the rental income of our homeowners is at the forefront of everything we do.

| Monthly Evictions For Baltimore Area

|

Monthly Evictions For Washington D.C. Area

|

Monthly Evictions For Philadelphia Area

|

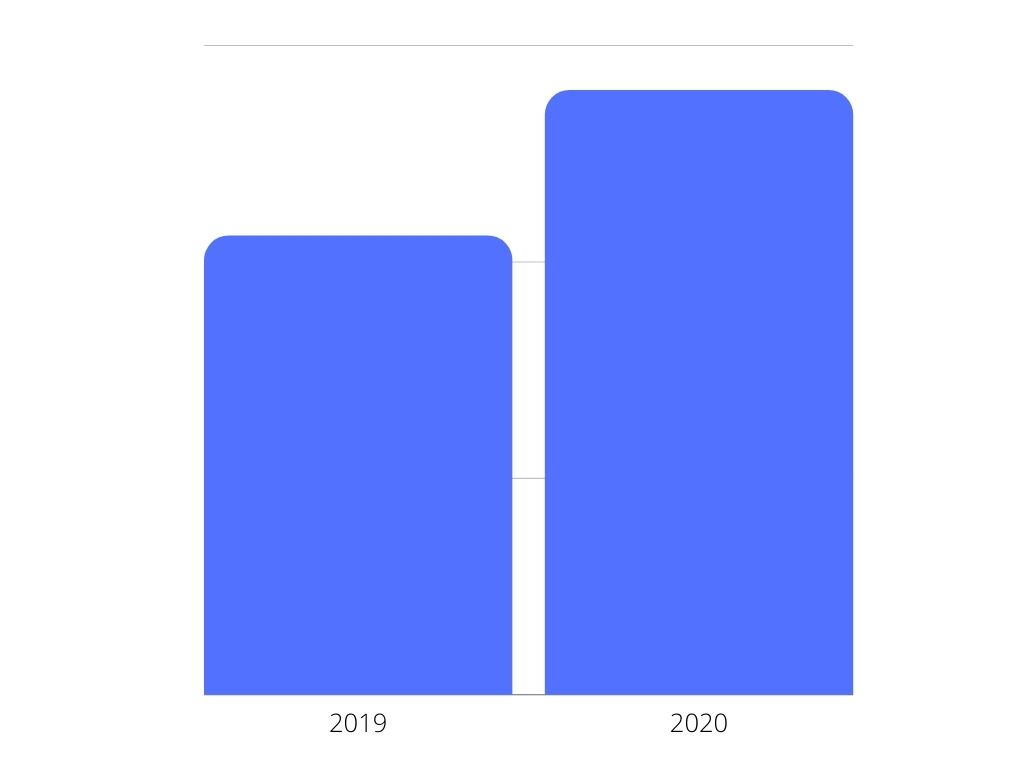

Rental Tenant Delinquency Rates Have Increased By Nearly 32%

Out of the nearly 4,000 dwellings that we analyzed across 3 different states comparing 2019 to 2020, on average, the tenant delinquency rate has increased by almost 32%. In some areas this number was even as high as 190%.

This means that because of COVID-19, at least 32% more families have been unable to pay their rent leaving landlords & homeowners forced to cover the bill themselves. In some cases, homeowners may have the funds to do this, but in other cases this leads to mortgage delinquency.

According to HUD’s July 2020 “Neighborhood Watch” report, 17% of 8 million insured mortgages are now delinquent. This percentage includes mortgages in forbearance as well as those not in forbearance.

So what does this mean for the future of renting?

Where Is The Rental Market Heading?

Does this mean that rental properties are no longer a sound investment? Is the rental market going to crash?

Here’s what the President of our Washington D.C. location, Nick Stone has to say:

“The Residential Property Management Industry is still thriving and will survive COVID. Many tenants are out of work and struggling to pay the rent. However, the current administration has done an excellent job allocating funding to rental relief programs, which is providing tenants the opportunities to get caught up and stay caught up on their rents.

In my opinion, I believe we will see a long-term stabilization (or decrease) in rent rates, specifically in major metropolitan areas resulting from the COVID outbreak. We are seeing a large supply of available rental units in Washington, D.C. This is starting to drive prices down due to the increased supply and low demand.

The demand is continuing to decrease as more and more companies have committed to allowing employees to work remotely. Tenants who know that they will be allowed to continue to work remotely are not renewing their leases in high-end city apartments. Rather, they are moving to surrounding counties where rents are much less expensive for equal or greater amenities.

I believe that this may have a negative effect on the housing market as it relates to property sales. If rents continue to go down in the larger cities due to low demand, the housing market should follow suit as investors start selling off their assets.”

On the flip side, the Washington Post reports that despite the concerns that most investors have around the pandemic’s effect on the real estate market, the Washington D.C. area has continued to see steady home sales and increasing prices. With the exception of April seeing a slight decline due to the shelter in place order and market’s reaction.

So what’s the point?

Despite the pandemic’s effects on the market, the rental property market is not going anywhere. Rental properties will continue to thrive as people continue to need sufficient housing.

What Homeowners Can Do During These Times

Property owners have to continue to apply logic and reason to their decisions. Additionally, negative emotions must be taken out of the equation if an owner is going to be successful. Remember that renters are not going anywhere and rental properties will continue to be a great investment in your portfolio.

Just like you would listen to your Doctor for medical advice and Financial Advisor for financial advice, rely on your Property Manager for Property Management advice. Property Managers like BMG are equipped to handle this pandemic so lean on us!

This doesn’t mean that the pandemic doesn’t present certain challenges. For example, many Washington D.C. landlords cannot even file on delinquent DC tenants for FTPR (failure to pay rent) and have not been able to do so since March. This just further emphasizes the importance of proper tenant screening.

A qualified and experienced property management company can help you find the best tenants available to rent your property, protecting your home & revenue.

Dana Anderson, President of our Philly location mentioned:

“Whenever the home sale market is oversaturated with supply and less buyers it results in more renters. I believe the rental market will remain strong no matter the economic constraints we are currently facing and likely to face.”

Why Homeowners Should Choose To Work With A Property Management Company

Our COO, Tony Cook, sums this point up nicely:

“Property Management is a very resilient industry and one that will live on through natural disasters, pandemics, economic collapses, and really most any other catastrophic event. COVID has certainly had its challenges and will continue to present more, however Property Managers are needed more than ever as investors struggle to deal with the complex issues that we face”.”

Here are just 3 major reasons investors should choose a property management company to help them with their real estate assets:

- Avoid bad or delinquent tenants.

In Baltimore, the eviction rate is at nearly 3.6%, which is one of the highest in the country. And nearly 275% higher than ours.

According to the Washington Post, 11 out of every 100 renters in Washington D.C. experienced an eviction filing in 2018. However, the team here at BMG works extremely hard to fit only the best tenants in the homes of our clients to avoid the unnecessary cost and hassle that comes with evictions.

By working with a qualified property management company like Bay Property Management Group, you’ll be able to find better tenants & continue to profit from your investments.

- Utilize COVID-Friendly Tools & Software As A Landlord

One of the biggest reasons you might consider choosing a property management company to help you during this pandemic, is to better keep you and your family safe.

A great property management company like BMG always take the necessary precautions and utilizes tools & software that allows us to offer things like:

- Virtual Showings

- Online Payments

- Online Maintenance Requests

- Virtual Meetings (When Applicable)

- 24/7 Customer Support

- Protect Your Investment

As a property owner, the care & maintenance of your property is an absolute necessity in order to protect your bottom line.

By using a property management company, you will take better care of your property. An experienced property manager will have seen it all and will be able to confidently handle any problems that arise with your property quickly and efficiently.

In Conclusion

Both the real estate, & rental markets have been drastically affected by the coronavirus. Tenant & mortgage delinquency rates are significantly up, evictions are paused, and a lack of filing fees & rent increases means more cost to property owners.

Despite all of this, real estate investors can not only survive this pandemic, but they can thrive.

For help managing your property and protecting your real estate assets, get in touch with Bay Property Management Group today!