Upon hearing the word depreciation, your mind might automatically go to the negative. However, for the savvy investor, depreciation signals opportunity! Rental property owners encounter many expenses throughout the year, chipping away at their bottom line. That said, not all expenses create a tangible impact on your cash balance. Depreciation is a paper loss that the IRS allows rental property owners to write off each year on their taxes. So, by using depreciation as a write-off, investors reduce their taxable income, allowing landlords to hang on to more of their money. Yes, this can be not very clear! Join us below as we take a more extensive look at why rental property depreciation is something you can use to your advantage.

Why Does Depreciation in Rental Properties Matter?

Depreciation comes in handy for both rental property tax deductions and within a landlord’s internal accounting. Understanding the process, along with what you can and cannot deduct, will save tremendous time and aggravation come tax time. On the other hand, depreciation for taxes does not always reveal a true picture of the investment property. Therefore, investors will want to track this separately or even use a different formula of calculation entirety.

How Does Rental Property Depreciation Work?

Rental property investors utilize IRS depreciation allowances to deduct the property’s purchase price and improvement expenses on their taxes. The IRS has strict rules on how to calculate depreciation and how to take deductions. For example, owners may not take the one large deduction based on the price and improvements. Instead, the depreciation value spreads out over time. On average, in the US, rental properties depreciate at a rate of 3.636% per year for 27.5 years. However, it is important to note that landlords cannot depreciate the land’s value, only the buildings on the property. Let’s take a look at a few quick rules regarding depreciation:

Criteria for Determining if a Property is Depreciable?

- You are the owner of the property.

- Is the property’s primary use a business or other income-producing activity?

- The property has a calculable useful life.

- Is the property expected to last for more than one year?

- Did you put the property in service and dispose of it the same year? If so, the IRS will not allow depreciation.

When Does Depreciation Start?

Depreciation begins when the property becomes listed for service. In rental properties, this is when you begin to advertise a property as ready to rent. This means the property is officially “in service,” and depreciation calculations can begin as of that date.

How Long Can You Claim Depreciation on a Rental Property?

A rental property will continue to depreciate until at least one of the two factors below occur.

-

An owner has deducted the entire cost of the property.

-

You sell the property, or it is no longer in use as an income-producing property.

What is Straight-Line Depreciation?

The IRS has a few different yet particular formulas to calculate depreciation. Straight-Line is the most common and easiest method, requiring owners to distribute the original cost over a specified period of time. That period of time hinges on the type of asset, residential or non-residential. Let’s break it down:

Residential Property

The IRS recognizes that residential property depreciates over 27.5 years for tax purposes. In order to be a residential property, a dwelling must, in part, show that 80% or more of the property’s gross yearly revenue is from dwelling units. The definition of a dwelling unit is a house or apartment used to provide living accommodations. Businesses that operate on a more transient basis, such as hotels and motels, are not considered residential property. Also, keep in mind that if the owner occupies a portion of the property, the gross rental income accounts for their portion’s fair rental value.

Nonresidential Property

A non-residential property depreciates over 39 years according to the IRS code. Simply put, nonresidential is just as it sounds. Properties in this category are not meant to provide living accommodations such as office buildings, retail stores, and warehouses. In the case of mixed-use property, where for example, there is retail on the bottom level with apartments above, it must meet the threshold of 80% gross income from dwelling units. If so, it depreciates as a residential property.

How to Calculate Rental Property Depreciation Using the Straight-Line Formula

Once you have determined eligibility, the straight-line formula is easily calculated with only a few simple numbers. To develop a value, landlords need to know the acquisition cost, land value, and the appropriate IRS depreciation period for their property. If you are unsure of what any of these values mean, continue reading below.

What is the Straight-Line Formula?

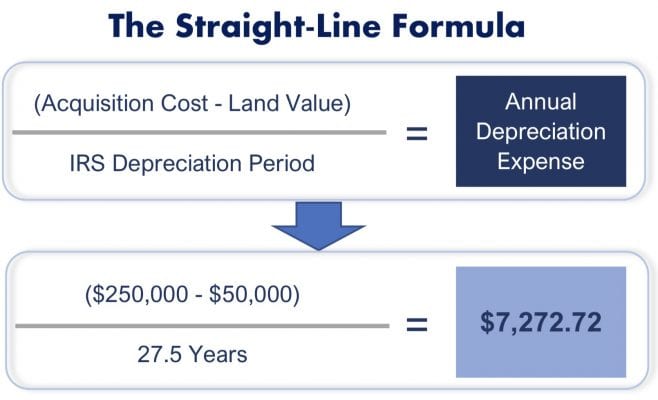

This is a straightforward calculation once you have gathered your figures. Simply subtract the land value from the acquisition cost and divide it by the IRS depreciation period. The result is your property’s annual depreciation expense. Take a look at this illustration below:

Let’s say you purchase a property for $250,000, and the assessed land value is $50,000. That leaves the building or improvement value at $200,000.

From there, we take $200,000 and divide it by the depreciation period, or 27.5 years. The result is $7,272.72, which is how much you can deduct each year for depreciation.

What is Acquisition Cost?

The expenses related to purchasing a property make up the acquisition cost. This includes the purchase price, taxes, and any improvements made. Occasionally, you may include some closing costs such as insurance premiums, rent for tenancy of the property before closing, and charges connected to getting or refinancing a loan. However, you will want to verify which charges specific to your situation you can include with a reputable tax professional.

How to Determine Land Value

Land value, also known as salvage value, does not depreciate. The logic here is that even if the buildings were one day no longer there, the land still holds inherent value. However, distinguishing the value of the land apart from the buildings on it can sometimes prove tricky. Generally, the assessor’s website will break down the land, improvements, and real estate value. Beyond that, you or your accountant can compare these figures with the purchase price to create an educated guess. Another solution that is particularly recommended with commercial property is to have a formal appraisal completed.

What is the Depreciation Period for my Rental Property?

Based on the IRS definitions above, is your rental property residential or nonresidential? The answer determines the lifespan or depreciation period for the property.

Pro Tip: Looking for an easy and quick resource to help calculate depreciation? Check out this helpful online depreciation calculator tool.

Beware of Depreciation Recapture

If you sell an investment property, you may find yourself becoming all too familiar with the term “depreciation recapture.” In a nutshell, depreciation recapture is when the sale price is greater than the tax basis. In 1986, the IRS mandated that all real estate depreciation use the straight-line method. Section 1250 of the IRS tax code addresses recapturing gains related to depreciation allowances previously used by the taxpayer. At the time of this article, the recapture tax rate is at 25% maximum.

The downside is this portion of the sale has taxes assessed at the recapture rate and not the more beneficial capital gains. It is a little confusing, so to illustrate this process, let’s look at an example:

Let’s say you purchased a rental property for $275,000, which has an annual depreciation of $10,000 ($275,000 / 27.5 years allowed by IRS for a rental property). After 11 years, you decide to sell. The adjusted cost basis would equal $165,000 or $275,000 – ($10,000 x 11).

If the sale price is $430,000, the realized gain equals $430,000 – $165,000 (adjusted cost basis) or $265,000. Therefore, the unrecaptured portion under IRS section 1250 is $10,000 x 11 or $110,000. This leaves the capital gains on the property sale at $155,000 or $265,000 – $110,000.

If capital gain tax is 15% and recaptured depreciation is at 25%, we can deduce the following –

The total amount of tax that the taxpayer will owe on the sale is (0.15 x $155,000) + (0.25 x $110,000) = $23,250 + $27,500 = $50,750. The depreciation recapture amount is, thus, $27,500.

In Conclusion

There are many facets to real estate investing, and understanding the tax benefits is a vital portion. Investors who carefully take advantage of these tax programs can turn an already lucrative venture into even more long-term profits. Successful investors also realize that the key to any great business is the people you surround yourself with. At Bay Property Management Group, we provide our clients with in-house accounting services, dedicated property managers, full-service tenant screening, and leasing, along with unmatched customer service. But we are more than just leaders in the property management industry; we are investors who understand the local market and the unique challenges real estate investors face. Interested in learning more about our property management services in Montgomery County and throughout Maryland, DC, Virginia and Pennsylvania? Reach out to one of our dedicated team members today!