Investing in residential real estate as a way to use passive income to build wealth. Successful investors know that owning a rental property diversifies your portfolio and creates steady income. That said, jumping into buying your first property can be a daunting task. It is important to know your financial capabilities, future goals, and most importantly, what constitutes a great rental property. In order to avoid these common investment mistakes, let’s take a look at the top ten features of a good rental property investment below.

10 Important Features of a Profitable Rental Property

The goal of any rental property investment is profitability. So, when evaluating a potential investment, the criteria differs from an owner-occupied home. Keep in mind; you are shopping for what renters will find valuable, and not necessarily your own personal taste. To aid in your search, check out these tips below.

- The Property Financials

- Location, Location, Location

- The Importance of Education

- Crime Steals Profits

- Jobs Draw in Potential Renters

- Convenience and Amenities

- Local Vacancy Rates

- Average Rent of Nearby Properties

- Steer Clear of Fixer-Uppers

- Natural Disaster Rating and Protection

The Property Financials

Once again, the goal of owning a rental property is to generate income through monthly rent. Luckily, investors can use some simple tools and calculations to help determine the viability of an investment. So, consider the tips below to ensure you are making a financially sound decision:

- The One Percent Rule – Can you rent the property monthly for one percent of its purchase price? In other words, if the annual gross rent equals at least twelve percent of the purchase price of the property, it is worth considering. This is a good starting point for a rental property return. It should also be the bare minimum you would be willing to accept in terms of the monthly rent.

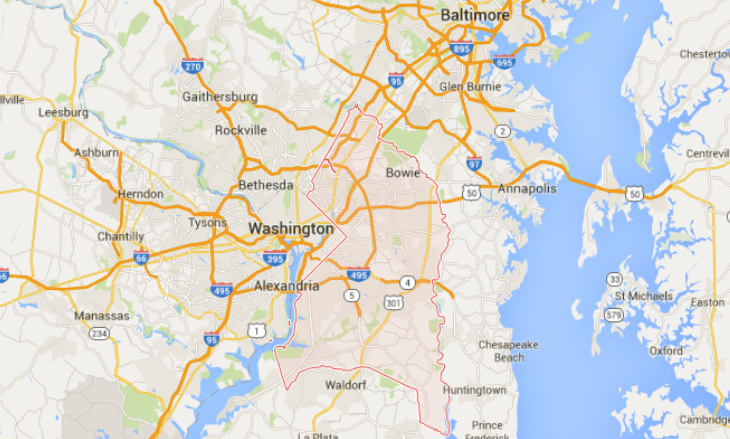

- The Cap Rate – Is the cap rate acceptable? Take a look at your monthly rent, subtract the estimated monthly expenses, and divide this total by the purchase price. This final figure is your cap rate, otherwise known as the approximate rate of return. Therefore, the percentage of return a property yields after this calculation will give you an idea if it is worth purchasing or not. If you purchase an income property in Prince George’s County, there is a high demand for quality rental homes. Thus, that high demand can translate to higher rents and higher returns for a savvy investor.

- The 50% Rule – How can a landlord anticipate the expenses of owning a rental property? Anticipating expenses you will incur is an important part of a successful property investment. As a helpful guideline, you can use the 50% rule, which states that an owner can plan for 50% of the gross income going to operate expenses. This is vital to consider when weighing your investment options and planning for just how much a rental property will cost you.

Location, Location, Location

Location is everything to a prospective renter and, therefore, to the landlord as well. Modern renters desire amenities and convenience. As one of the most important aspects of a good investment, you must research the location of your property before investing in it. A great location near schools, shopping centers, local transportation, and more can mitigate the property’s shortcomings.

Additionally, choosing the right location directly impacts your pool of applicants. For instance, areas near college campuses mean students will likely make up a large part of the rental group. Also, check out local codes and requirements; you could pay hefty fees in some areas instead of others. These fees or higher taxes cut into a landlord’s profit margins, so choose wisely because locations cannot change.

The Importance of Education

Tenants that have children will surely be on the lookout for good schools in the area they are living in. So, check out local school ratings and use this as an indication of the neighborhood as a whole. High performing schools of all levels should surround the property you choose to invest in so your tenants will feel confident their children are getting the best education possible. One great option for rental property investment is the city of Bowie. Boasting a small-town feel with city amenities, Bowie has it all. Also, Bowie is home to Bowie State University. It is a college providing high-quality education and a comprehensive learning environment for students.

Crime Steals Profits

Everyone wants to feel safe in their home, and therefore a rental in a crime-ridden area will not draw the quality tenants, and profit investors need. That said, locations with high crime rates are not always so obvious. So, investors must turn to local crime reports and statistic reports to get a clear picture of a location’s state. After which, you will be able to tell whether the home you are looking to purchase is in a safe neighborhood.

Investors may find easy deals in riskier neighborhoods, but that low cost translates to lower rent and potentially higher turnover. You can bet your potential tenants will check before signing the lease agreement, so stay ahead of the game and not invest somewhere unsafe.

Jobs Draw in Potential Renters

Nearby employment opportunities are an incentive for people to rent homes in a specific area. See how particular area rates by going to the U.S Bureau of Labor Statistics. The key is to find a location with a low unemployment rate and steady growth of local businesses. When a rental property is near an employment hub, demand is high. To pay their rent on time, stay long-term, and make more money for you in the long run. Besides, reliable employment will result in less job transfers for your tenants, hopefully lowering the chance they may break your lease agreement early.

Convenience and Amenities

For tenants, renting a home is not just about the actual physical property. Although there are plenty of top-notch amenities tenants look for in a rental home, there are external amenities that are important too. Landlords are not only marketing a property but the lifestyle it provides. Therefore, things to do and places to go in the surrounding area will add value to your tenants’ daily lives. For instance, investing in an area such as Laurel is a smart move because it offers convenient shopping, proximity to commuter routes, three annual festivals, and plenty of entertainment. When you plan to invest in a rental property, these neighborhood amenities are a great addition to marketing descriptions.

Local Vacancy Rates

Not much is more telling than the vacancy rate in the local market. If there are an unusual amount of listings or vacancies near the property you are thinking of investing in, take a closer look at why. Vacant homes surrounding the home you invest in can devalue the property and harm your bottom line. It is possible that high vacancy rates could signal a seasonal cycle, so investigate further to verify it is not a sign of a poorly located property.

Average Rent of Nearby Properties

The monthly rent a landlord collects directly impacts the profit potential. Therefore, getting the best rental return is vital to overall success. Evaluating the going rental rates of similar properties will help confirm your choice to invest in a particular property. Use this information to compare your property against the competition using the 1% rule, 50% rule, and cap rate formula. It is important that investors not overpay for a property and not be able to recoup their investment. Similarly, when you lease the property, you do not want to undercharge and leave profits untapped.

Steer Clear of Fixer-Uppers

Investing in a fixer-upper has many downsides for investors not well-versed in construction projects. Ideally, you should invest in a property that you can market quickly. If you purchase a rental property that is not rent-ready, you could end up eating into your annual profit before ever renting to the first tenant. A full rehab or major repairs costs both money and valuable time. These properties are best suited to investors with a larger portfolio that can afford to take on a larger project with extended vacancy time.

That said, it is not a complete bust if you come across a property that seems perfect in all aspects, minus some minor repairs. Cosmetic repairs or simple upgrades are a good idea for any investor as long as they can be made quickly, efficiently, and on a budget.

Natural Disaster Rating and Protection

Certain locations throughout the country have to consider the potential threat of natural disasters. However, wherever you choose to invest, it is a good idea to get an idea of what may be in store for you in the future regarding nasty weather. As the owner of rental property, you will likely insure your home against any type of physical damage to the building structure. While this expense does chip away at your annual investment profit, not preparing for commonplace natural disasters will do much more harm.

Where can Landlords Start Looking for Investment Property?

Starting your search with a qualified real estate broker is the best option. A realtor has the connections, know-how, and experience to handle making offers and fostering deals. However, investors must be proactive in the search and not just rely upon deals coming to them. So, with that in mind, check out these top online sites for investment property listings below.

- REALTOR.com – Realtor.com is the official site of the National Association of Realtors. Offering home value tools, automated search assist, and real estate statistics allows investors to type in a street address or zip code to view homes in the area.

- Trulia.com – Landlords can take advantage of a user-friendly website that allows you to search by any criteria as well as see crime statistics, price history, foreclosure status, and school ratings.

- Auction.com – Auction.com auctions all types of real estate, including foreclosures, REOs, short sales, commercial property, luxury real estate, new construction, and vacant land. Once you have created a free account, check out the convenient how-to guides that detail the proper steps to begin bidding at auctions.

- Craigslist.com – The “real estate for sale” section of Craigslist allows investors to see available properties in a specific area. Additionally, this is a great way to discover deals through for sale by owner properties.

- RealtyTrac.com – This site focuses on foreclosures, which can prove to be a daunting undertaking for new investors. That said, it is still worth looking into. In addition to listings, RealtyTrac boasts added housing information, including valuable how-to articles, statistics, and of course, foreclosures.

Final Thoughts

Investing in a rental property has lucrative potential if done with proper planning and an understanding of what makes a good investment. As a landlord, it is your responsibility to choose wisely and invest in a property with the best chance of profiting each year. For investors, purchasing the property is just the start.

Therefore, consider using an experienced Maryland rental management firm such as Bay Property Management Group to handle your rental business’s day-to-day needs. Finding the property that will work for you and your potential tenants is a lot of work, but managing your property does not have to be. Let the area’s top property managers take over and give you back your free time along with the peace of mind that all is being handled properly, in compliance with local and state laws, and at a profitable rate of return. Give us a call today for more details on our services.

I agree that location is key when choosing a good rental investment property. Choosing the right place, could really affect who the tenants are. Having good tenants makes owning the property much easier. I wholeheartedly agree that the most important thing is location, location, location.

Thanks for your message Cheryl!