If you ask the older generations what was their best investment during the course of their life, a lot of them would say their home. The general premise is that over time, houses tend to appreciate in value, and you end up paying off the debt year over year, so down the road you have tons of equity in the property. In this blog, I am going to discuss some benefits of renting a house and argue why renting is a better option than home ownership for the current millennial generation.

In today’s world the average millennial is much less likely to work in the city they grew up in. Through globalization and technology, it has become easier and easier to find jobs in other cities, and thus packing up and testing out a new city has never been more effortless. If you purchase a home, statistics show you are much less likely to pack up and move to a different city vs if you are renting. There is no hard evidence to understand why this is the case, however one could hypothesize that the homeowner feels trapped with their home and unwilling/unable to pack up and leave. When the average homeowner purchases a home, they typically start underwater. That is simply due to the fact that the homeowner ties the closing costs into the mortgage. Also, if the homeowner were to sell the property they would have to pay a realtor to sell the property along with transfer/recordation taxes. The cost to sell your property for most homeowners is about 7.5% of the total cost of the house (6% to a realtor and 1.5% for transfer and recordation taxes). The most common mortgage in the United States is a 30-year fixed mortgage. If you get a 30-year fixed mortgage for your property, the first few years almost all of the mortgage payments to the bank each month are for interest, and very little of that mortgage payment is going to pay off the actual debt on your house. Here is a URL link to an amortization schedule for a 30-year fixed mortgage for a house that is purchased at $300,000. https://www.myamortizationchart.com/

You will notice that to have more than $40,000 of the house paid off, you will have to live there for over 7 years.

If you purchase a house you will most likely want to furnish the house with couches, chairs, paintings, beds, tables, TV’s, etc… Aside from furnishing the house, you will need to have money set aside for any repairs or maintenance items that come up such as a roof leak, new siding, HVAC system, hot water heater, windows, toilets, locks, yard maintenance, etc..

Over the last 10 years, the average length of time a homeowner lives in their house is for 8.4 years. The prior 10 years from 1998-2008 the average length of time a homeowner lived in their house was just over 6 years. From these statistics, I would venture to say that most homeowners did not make much money when they sold their house simply due to the length of time the homeowner lived in the house.

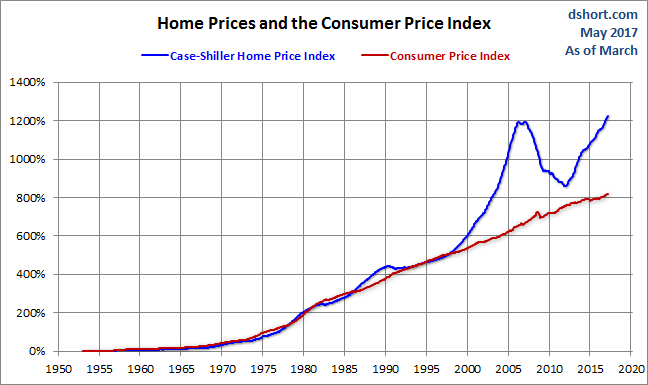

I have given a few negatives to homeownership, but let’s look at some of the positives from becoming a homeowner. First is the tax deduction you are able to take as a homeowner. You are able to deduct all of the interest on your mortgage payment, along with the property taxes against your income each year. Another benefit is that houses tend to appreciate in value over time. Home prices have appreciated nationally at an average rate between 3-5%, depending on the index used for the calculation. Real Estate tends to be an inflationary hedge, so its appreciation is somewhat tied to the inflation rate. There is a reasonable connection and correlation to the inflation rate and home price appreciation. The link shows the correlation between home price appreciation and inflation.

Another benefit of renting is many cities in today’s market have been overbuilt with apartments, so the apartment complexes are offering tremendous deals to fill up their buildings. I think now is one of the best times to be a renter. You have negotiating power when you walk into an apartment or rental and are looking for a good deal. Many of the larger institutional groups have given their communities the leeway to negotiate pricing on their apartments. As home prices continue to climb, renting is becoming the more affordable option.

My argument would be if you are not dead set on holding onto your house for a long period of time (at least 15 years) it doesn’t make sense to become a homeowner. Some millennials will say they have extra cash and purchasing a home would be a good investment. If that is the case, I would recommend putting your money into a low-cost index fund that charges something like 7-10 basis points per year that mirrors the S+P 500. Here is a link to the returns from the S+P 500 over the last few decades.

The average return over the last 30 years has been just shy of 10% year over year in the S+P 500. A home does not come close to these types of returns.