As a landlord, success often hinges on receiving timely and complete rental payments. Therefore, creating comprehensive rent payment policies will help streamline operations and ensure you have the best chance of receiving all payments due. So, join us below to review how to create rent payment policies and some software options to make a landlord’s job easier.

How to Create Efficient Rent Payment Policies

Creating rent payment policies is just one of the many important jobs for landlords to have a successful rental business. Check out the top things every owner must consider below to build the policies that work for them.

Rent Payment Policies in the Lease

Every rental agreement must clearly state the amount of rent due along with any special conditions. This is important because owners will have a difficult time holding tenants to them unless the terms are clearly stated. Check out the example of one lease’s rent payment policies below –

- “Tenant shall pay to Landlord a “Monthly Rent” in the amount of <<Monthly Rent>>Dollars, which must be paid in advance, without notice, deduction, setoff, or demand by the first (1st) day of each month of the Initial Term. If the rent is paid after the fifth(5th) day of the month, the tenant agrees to pay as Additional Rent a late charge equal to five percent (5%) of Monthly Rent for the rental period which said payment is delinquent (in addition to costs of collection, which may include Landlord’s actual, reasonable attorneys’ fees and court costs, even in the event that the case is dismissed voluntarily by Landlord, unless a judgment in favor of tenant is entered by the court after trial). The tenant may not withhold or offset Monthly Rent or Additional Rent unless authorized by law.”

A few things lease rent payment policies must include are –

- Amount Due

- Frequency Due (typically monthly)

- Due Date

- Grace Period Conditions

- Late Fees and Penalties

Types of Payment Accepted

It is important to define which forms of payment are acceptable clearly. Let’s take a look at the various payment methods landlords can accept, so you can decide which works best for your business.

- Electronic Payment – Accepting electronic payments via ACH or credit card has become a requirement of the modern renter. That said, advancements in technology continue to make this option more efficient for landlords and more secure for tenants. Additionally, tenants using electronic payment can set up automatic withdrawals, so they never miss a payment.

- Money Orders – Money orders are easy to get and offer the benefits of a check without having a checking account. Tenants can purchase a money order for the amount of their rent using cash or a debit card and receive a receipt that can help trace the funds if needed. The downside is that the funds could become lost in the mail or delayed, and landlords will need to make a trip to the bank.

- Personal Checks – Accepting personal checks is a risky business. Like money orders, mail can delay their arrival, but there is also the chance of the check not being honored by the bank. This creates a hassle for landlords and the need to assess returned check fees and continue to wait for payment. So, if you decide accepting personal checks is an option, ensure tenants are aware of any applicable returned check fees or conditions.

- Cash – For several reasons, some tenants may want to pay cash. However, accepting this form of payment is not advised. Accepting cash may make landlords more susceptible to theft or attract tenants engaging in illegal activity. Therefore, make every effort to avoid accepting cash. If the tenant persists, consider requesting that they purchase a money order instead.

Best Rent Collection Software for Landlords

Whether you are an individual landlord managing a couple of units or an LLC with a large portfolio, technology can help simplify critical processes. For example, timely and convenient rent collection is at the forefront of every landlord’s mind. Check out these top rent collection and property management platforms that help make being a rental owner a breeze.

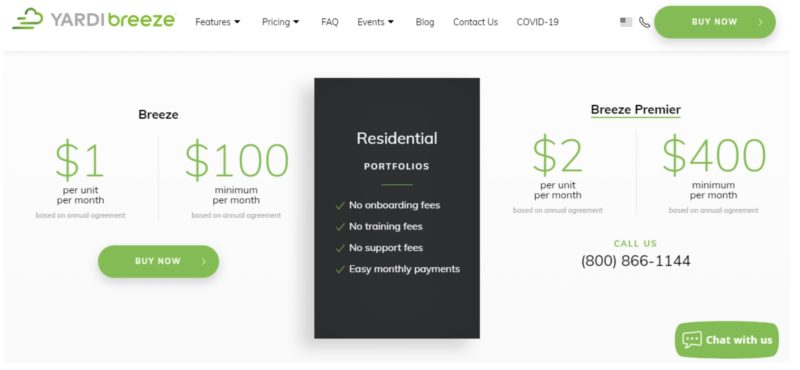

Yardi Breeze

Yardi Breeze allows owners to combine leasing, marketing, and accounting operations with the help of one convenient platform. This comprehensive software is an industry leader supporting residential, commercial, manufactured home communities and self-storage portfolios.

The user-friendly online portals allow tenants to easily pay rent and landlords to track and collect funds easily. In addition, Yardi Breeze offers reporting options to monitor key metrics within your rental property business. Also, easily track and manage maintenance needs, invoices, and outstanding to-do list items from one central dashboard. Finally, if you find you need a little more in-depth features, Yardi offers a Premier subscription to unlock even more helpful services.

Pricing: Starting at $1 per unit with a $100 monthly minimum based on an annual agreement

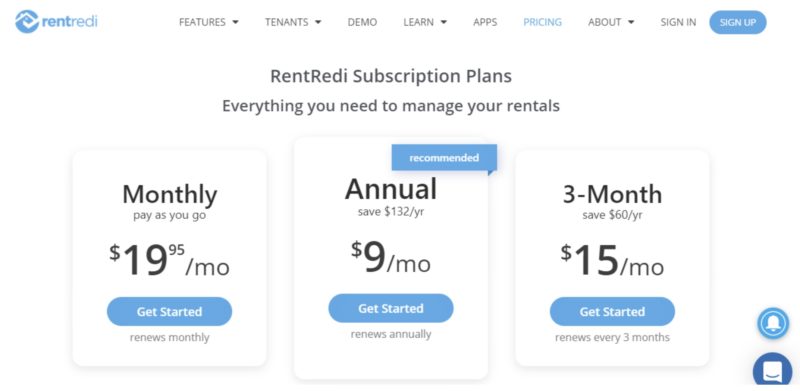

RentRedi

RentRedi software empowers property owners to manage every aspect of their rental business easily. The all-in-one dashboard allows landlords and tenants to process mobile-friendly rent payments and send in-app notifications. In addition, the RentRedi platform can prequalify and screen tenants, easily apply, submit maintenance requests, as well as making payments. Take a look at their website for a full list of all features but check out the list below for a few highlights –

- Collect rent payments from mobile or web via ACH, cash, or credit card payments

- Enable partial or block payments

- Link more than one bank account with no added fees

- Easily send in-app communications, rent-reminders, and automated receipts

- Securely screen tenants for credit, criminal, and eviction reports

- Built-in prequalification questions

- Convenient mobile application submission

- Online lease signing and maintenance requests

- Free listings on Realtor.com

Pricing: Monthly pay as you go plans begin at $19.95, with savings available for paying annually

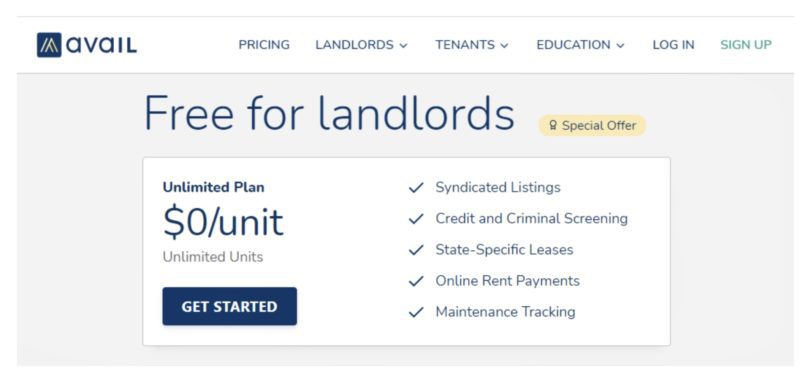

Avail

Property owners can feel confident in their abilities with a little help from Avail. Along with helping owners find, screen, and qualify tenants, Avail software makes collecting rent a breeze. Landlords can quickly link their bank account and set up direct deposit, so you never have to worry about making it to the bank. In addition, tenants receive an easy-to-follow instructional email on how to submit rent and security deposit funds. Moreover, tenants can make payments through ACH or using a credit card. Let’s review a few of the key features Avail has to offer below –

- Specialized Rent and Fee Collection – Avail allows tenants to pay rent, set up automatic payments, sign up for rent reminders, and build credit through on-time payments with CreditBoost. In addition, owners can take advantage of next-day direct deposit and auto-assessed late fees for added convenience.

- Online Screening and Leases – Screening tenants is one of the most important steps to renting out your investment property. That said, Avail makes it easy to request and review credit and background screening reports to help choose the best applicant. In addition, this software allows owners to customize lease agreements and quickly send them to tenants for signatures.

Pricing: Unlimited Plans begin at $0 per month and only $5 for a Premium Membership

How to Have Stress-free Rent Collection and Rental Management

When it comes to collecting rent, time is of the essence, and your profits are at stake. That said, there are many things landlords can do to encourage timely rent payment from their tenants. These include thorough tenant screening, making paying rent convenient and simple, utilizing rent reminders, and enforcing late fees per the lease terms.

While modern software platforms make some daily operations easier for landlords to manage, they still require time, effort, and know-how on your part. However, hiring a professional property management company like the experts at Bay Property Management Group can allow landlords to rest easy knowing their portfolio is well looked after. Our team of qualified managers, in-house accounting staff, professional leasing agents, and experienced maintenance technicians handle every aspect of your rental business while helping to maximize your investment. So give us a call today and see how full-service management can benefit your rental.