The COVID-19 pandemic hit landlords hard in 2020. Therefore, with 2021 in full swing, many property owners wonder what the rental market has in store. As regulations tighten and many industries still struggle on the road to recovery, proactively planning for your rental is essential. How much should I charge for rent? Will I be able to increase the rent in this year’s market? Both are critical questions to maintaining a healthy investment property profit margin. So, join us below as we discuss rent estimates and rental market trends that will affect landlords through the end of this year.

Will Rent Estimates Go Up or Down in 2021?

Many experts still predict a recession is imminent in 2021. Whether that turns out to be true will certainly affect the housing market. So, as the economy and job loss continue to be an issue, let’s look at what experts say about rent estimates below.

Rent Estimates Likely to Plateau in Early 2021

Overall, experts expect rent prices to remain stable during the first half of 2021. This is mainly due to continuing job recovery and the ongoing rent increase and eviction freezes in many areas. That said, across the board, renters are viewing urban locations as less desirable places to live. Especially now that working remotely has become the new normal for a large portion of the workforce.

Therefore, this viewpoint directly affects the rent estimates and vacancy forecast in many city rentals. Additionally, a push towards renewing existing tenants to avoid costly vacancy is also driving rent stability. Even if allowed by law, many landlords choose not to increase the rent as a means to keep the unit filled.

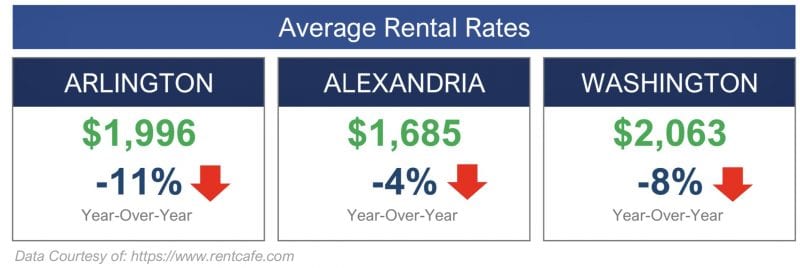

In particular, high-end or “class A” properties have been the hardest hit during the COVID-19 pandemic. Landlords find themselves managing longer vacancies and offering free amenities in an effort to secure a renter. Throughout the area, rental rates are down year over year and more than 10% in some cases.

Average Rental Rates Throughout the Area

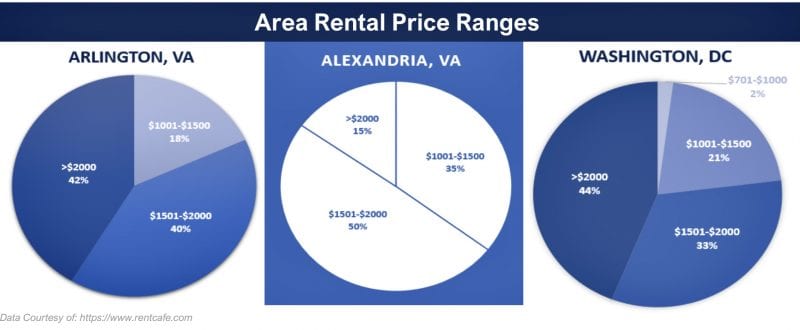

Arlington, Virginia

- Average Rental Rate: $1,996, which is Down 11% Year-over-year

- Percentage of Listings in this Rental Range: 40%

Alexandria, Virginia

- Average Rental Rate: $1,685, which is Down 4% Year-over-year

- Percentage of Listings in this Rental Range: 50%

Washington, DC

- Average Rental Rate: $2,063, which is Down 8% Year-over-year

- Percentage of Listings in this Rental Range: 44%

Although rent estimates have fallen below pre-COVID-19 rates, the current trends are expected to stabilize over the next several months. Therefore, with so many vacant units on the market, landlords will need to price according to local comps now more than ever.

Rebounding Rates in Late 2021 – But with a Twist

By the end of 2021, certain markets and areas may see a slight increase in rent estimates landlords so desperately need. However, these increases will be mostly concentrated in suburban areas that have become a hotspot during the pandemic. Work from home employees now have more freedom and are not bound by commuting to and from their job.

Also, the limited availability of social activities has meant more time spent within the four walls people call home. Furthermore, city life’s appeal, such as eclectic dining and entertainment options, remains closed or at least restricted during the pandemic. Even in areas where these businesses have bounced back, renters decide it is not worth the risk.

So, without the upside and convenience of city life, leaving to save big outside urban areas is a worthwhile option. Therefore, many have opted to move somewhere that offers additional interior and exterior space for recreation. That balance of work, home, school, and entertainment spaces is more often than not found in single-family homes.

Consequently, inner-city rates will likely remain low throughout the year, while single-family suburban homes will rise. Even with the shift to the suburbs, experts still believe that demand for low and mid-range multi-family housing units will always be strong. However, only time will tell whether these individuals choose to stay in the newfound solace of suburban life or head back to the bustling city.

Other Rental Market Trends to Watch in 2021

Home Prices and Rates Will Climb in 2021

Despite economic uncertainty, many individuals chose to take advantage of near record-low mortgage rates and look into purchasing a home. However, supply has not kept up with the demand. In turn, this has driven up the prices of what homes are available on the market, leaving many buyers without an option.

That said, by the end of 2021, expect mortgage rates to increase. Thus, slowing down the rate of people looking to buy. As a result, the higher rates may shift focus back to affordable housing options in the rental market.

New Construction Facing High Cost and Delays

Unprecedented demand drove up the cost of new construction in late 2020. That, combined with supply chain issues due to the pandemic, means the prices will remain high for the foreseeable future. The lumber industry was particularly impacted by rising new builds and regular homeowners using the time to complete long-awaited upgrades and renovations.

So, with costs high, profit margins for builders decrease. Therefore, many are choosing to focus on only high-end homes, leaving the mid-range demand unfulfilled. That said, this could prove to be a bonus for landlords as these individuals or families will need at least temporary housing. Currently, according to RentCafe, figures throughout the area show a balanced split between renters and owners. However, that could change over the next two to three years.

Real Estate Housing Makeup

- Arlington, VA – 53% of households are renters compared to 46% owner-occupied

- Alexandria, VA – 51% of households are renters compared to 48% owner-occupied

- Washington, DC – 56% of households are renters compared to 43% owner-occupied

Rental Market Regulation Will Increase in 2021

Landlords have realized more than ever how much of a role the government plays in housing. Between renewal freezes, eviction moratoriums, and rent control, property owners must sift through the ever-changing regulations. However, even as the federal requirements begin to ease, local jurisdictions are stepping up to continue the changes.

In some areas like Massachusetts, the rent control efforts will go well beyond the pandemic. In fact, they are planning to extend regulations for a year after the pandemic ends. Meanwhile, other states have already extended rent control and retroactive rent control measures into 2021. Effectively, this changes the rental market as we know it.

Although these discussions remain in areas where rents rose faster than income, that will not remain so. As housing prices rise, the pressure is on rentals to supply the growing affordable housing shortage to meet the need. However, in a time of low cap rates, investors worry that restrictions on raising rent mean they will not meet their costs and maintain a profit.

Growing Need for Professional Property Management

Growing Need for Professional Property Management

Complex restrictions and decreased margins mean every decision is more critical than ever. This confusing and stressful time has more property owners turning to a professional property management company’s services. These companies play a vital role in balancing the need to secure a qualified renter and the investor’s bottom line. However, their ability to stay abreast of changes in the local market and housing regulations, as well as industry expertise, will help them accomplish just that.

Final Thoughts

The COVID-19 pandemic continues to be a wildcard in the rental industry. As landlords continue to navigate the changing legal landscape while maintaining profits, why not enlist some help. The industry experts at Bay Property Management Group provide the support owners need to weather the storm. Rest assured that as the market changes, our team adjusts to keep your best interests in mind. Give us a call today to find out how a rental property management company can assist you in realizing your investment’s full potential.

Growing Need for Professional Property Management

Growing Need for Professional Property Management