As a property owner or real estate investor, hiring a property manager can alleviate all kinds of headaches in your day-to-day operations. Property managers handle all aspects of running your investment, from vetting tenants to emergency maintenance and everything in between. If you want to collect rent but don’t have the time or inclination for the multitude of other tasks, hiring a dedicated property manager is well worth the investment. So, how much are property management company fees? What do the fees typically cover? How do you know you have found the right fit? Read on as we discuss the answers plus a ton of helpful tips below!

What are the Typical Rental Property Management Fees?

When researching potential rental management companies, fees are a significant deciding factor. Ask plenty of questions to fully understand what you expect to pay, included items, and what additional costs may come up. Remember, different elements may influence the fees for services, so make sure you prepare for them all.

What Factors Influence Property Management Costs?

- Location: Property managers may charge fees based on the area and rental amount. In other words, lower costs to manage properties in areas that command lower rents, or higher prices for luxury listings.

- Type of Property (Single-family, Multi-family, Commercial): It is relatively basic, but managing a larger property or number of units requires more resources. Therefore, fees may be higher.

- Condition of the Property: Newer or renovated units may have fewer maintenance issues than older properties.

- The extent of Services Provided: The services provided affects how much you are charged. You can choose to do full-service or decide to take on some tasks yourself. So, depending on what services the company is handling, you may be able to negotiate lower property management company fees.

Typical Fees Charged by a Property Management Company

The total cost to oversee your home depends on many factors, such as the ones listed above. Typically, there are two types of associated property management company fees; fees paid to the management company and fees paid to other parties. Continue reading to learn more about how to tell the difference.

What Are The Typical Property Management Fees Paid to the Management Company?

- Start-up Fee: Many companies charge a start-up fee ranging from $100 to several hundred. This usually covers administrative time associated with getting your contract processed and even an initial inspection. Since this fee can vary widely, be sure to ask!

- Monthly Management Fee: You can expect to pay between 8 to 12% of the monthly rental income of the property. Depending on the rental amount, some companies may instead charge a $100 or higher, per month flat rate. That said, confirm whether this fee is on the rent collected or the rent due. If it is rent due, you may be paying them even if the tenant isn’t paying rent.

- Leasing Fee: Leasing fees cover the advertising costs and leasing agent commission for them to show rent, and prepare paperwork for your tenants. You can expect to pay around 50% up to a full month rent as a leasing fee.

- Renewal Fee: A renewal fee helps cover administrative time in processing renewals for your property. This includes but is not limited to market research, preparing renewal offers, negotiating with tenants, and preparing new lease documents. That said, they can range from $100 to several hundred dollars but are typically less than one month’s rent.

- Inspection Fees: Inspections are vital! Most companies charge a fee to send technicians out for detailed move-out or periodic inspections.

- Early Termination Fee: If you break a property management contract early, you will often pay an early termination fee. This fee varies greatly from company to company, so carefully read the terms of your agreement.

Examples of Miscellaneous Fees Paid to Other Parties

Examples of Miscellaneous Fees Paid to Other Parties

Not all expenses that come up will go directly to the property manager. Many maintenance costs, compliance inspections, and fees will need to go directly to local authorities or vendors. Below are a few examples of miscellaneous expenses to be aware of.

- Eviction Fees: Evictions are a tedious and time-consuming process. Therefore, a property manager will charge for processing the eviction of a tenant. Typically, this ranges from around $200 to $500 per eviction, plus any applicable court costs.

- Court Costs: Generally, this includes fees for serving notices, dealing with attorneys, and court appearances, etc. While some companies charge hourly rates from $25 to $50, others may favor a flat fee of around $500. However, there are additional court costs not included in this fee.

- Compliance Fees: Lead paint inspections and certifications, rental license inspections, or housing certifications are all added fees you will need to budget for depending on the requirements in your area. These can easily range from $300 to nearly $1000.

- Maintenance Costs: A property manager facilitates repairs, but it is up to the owner to pay for those repairs. Depending on how the property management company is set up, you may be paying them directly so they may pay the vendor, or you will be paying the vendors directly.

How Can You Prepare for Unexpected Maintenance Costs?

How Can You Prepare for Unexpected Maintenance Costs?

No one can predict the future, but it is a good idea to plan for it anyway. Unexpected emergency repairs can not only be costly for owners but potentially financially devastating. Chances are maintenance costs will be higher than you expect and certainly more than you want. No matter how much you plan for, it is a good idea to set aside a separate account dedicated to emergency funds just in case. While there is no perfect formula, check out some ways to estimate maintenance costs below.

- The 50% Rule: Your total operating costs (repairs, maintenance, taxes, insurance) will equal 50% of your rental property income. So, if your property rents for $1,000/mo, you should expect $500 of that to go towards upkeep.

- The 1% Rule: Maintenance will cost about 1% of the property value per year. Therefore, if the property value is $200,000, it should cost $2000 a year to maintain.

- Square Footage: Plan on $1 per square foot in yearly maintenance costs. So, a 1000 square foot rental should cost around $1000 a year to maintain.

How to Reduce Property Management Costs?

Any fees you must pay, whether for elected or required services, affect your bottom line. So, while weighing the option of hiring professional management, you should also examine ways to reduce costs and boost profits. Check out these simple tips below that can make a significant impact.

- Prioritize Tenant Screening:

- Routine Maintenance:

- Reduce Turnover

Prioritize Tenant Screening

Careful tenant screening during the leasing process protects the owner, property, and the community. Therefore, it must be taken seriously as a vital part of renting the home. Typically, tenants are screened on a variety of criteria, all while strictly adhering to Fair Housing Laws. Examples of tenant qualifications are below.

Common Rental Qualification Factors

- Rental History Verification

- Credit Worthiness

- Income Requirements

- Background Check

Important Tip: In recent years, some major cities, states, and federal courts moved to restrict the use of criminal and eviction records in tenant screening. The Tenant Protection Act would prohibit your tenant screening provider from showing eviction records on your report unless the file was no more than three years old, current guidelines are up to 7 years.

Routine Maintenance

Benjamin Franklin once said, “An ounce of prevention is worth a pound of cure.” Well, the ounce of prevention can prove to be significant savings in the long run by both keeping your property in good shape and your tenants happy. Follow up on maintenance calls to ensure tenants are satisfied with the work completed. Remember, this is where the tenant calls home; if they feel ignored or deal with poor service, they will not want to stay long-term. Turnover of properties costs far more than trying to keep a great tenant satisfied. When thinking of your maintenance strategy for your rental property, consider the tips below.

Tips for Successful Rental Property Maintenance

- Respond promptly to all maintenance requests

- Conduct routine inspections

- Maintain open lines of communication with tenants

- Complete preventative measures on large ticket items such as HVAC

Reduce Turnover

A vital component of a successful investment property is consistent occupancy with the right tenant and minimum turnover. Keeping good tenants not only reduces turnover, but it also likely reduces wear and tear, improves income, and lowers your expenses. That said, tenants may leave for a variety of reasons, not all of which you can control. However, focus on the circumstances you can control. To do all you can to maintain tenant satisfaction, follow these basic guidelines below.

Top 10 Tips to Maintain a Successful Landlord-Tenant Relationship

- Regular Communication

- Promptly Respond to Tenant Requests

- Be Proactive

- Address Maintenance Issues Completely

- Handle Complaints Effectively

- Consider a Loyalty Program or Incentives

- Provide a Welcome Package

- Consider Sending Birthday or Seasonal Cards

- Get Everything in Writing to Avoid Misunderstandings

- Conduct Regular Inspections

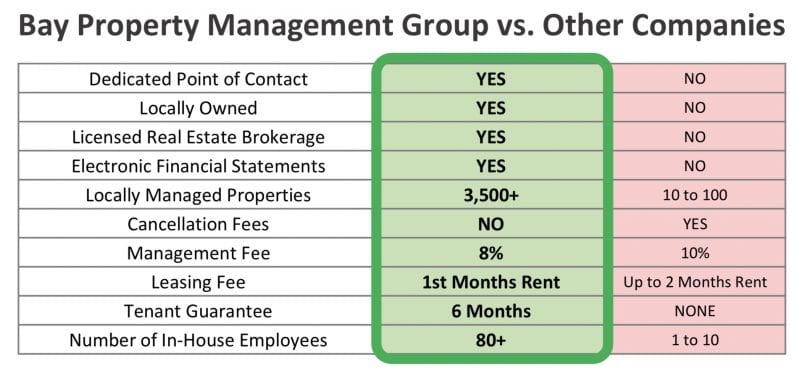

How Does Bay Property Management Group Compare?

Bay Property Management Group is the area’s leading full-service property management company. Our dedicated team of over 80 employees currently manages over 4,000 units across Baltimore, Philadelphia, and the Washington DC Metro area. We understand your property is a valuable asset. Bay Management Group is a trusted residential property management company focusing on customer service for our tenants and satisfaction for our owners. We offer competitive pricing and management fees that are transparent to all investors. Check out our standard charges below.

Bay Property Management Group at a Glance

- Dedicated Point of Contact: Yes

- Locally Owned: Yes

- Licensed Real Estate Brokerage: Yes

- Electronic Financial Statements: Yes

- Locally Managed Properties: 3,500+

- Cancellation Fees: No

- Management Fee: 8% or $100, whichever is greater

- Leasing Fee: 1st Months Rent

- Tenant Guarantee: 6 Months! If we place a tenant that is evicted within the first six months, we will lease your property for FREE!

- Number of In-House Employees: 80+

- Positive Online Property Management Reviews

How to Choose a Qualified Property Manager

Choosing a property management company comes down to many factors and often complex circumstances. That said, some good rules of thumb can help you in making your decision. Read on to discover our top 10 things to look for to make sure your property manager is the best fit for your investment.

Tips for Choosing a Property Manager

- Specialized Experience: Property management is made up of many moving parts. Therefore, an investment property manager must stay on top of current federal, state, and local laws. Seek out companies with a proven track record with similar investment properties to your own.

- Professional Licenses and Certifications: Not all states have the same requirements for property managers. However, competent management companies can back up their expertise with proper licensing and certifications. Your state’s real estate commission can confirm if a property manager’s real estate broker’s license is current. Additionally, any professional affiliations or certifications are a huge plus.

- Property Management Reviews: Take time to read through property management reviews on Google as well as the company’s social media pages. That said, keep in mind that some bad reviewers may have an ax to grind that has no bearing on the quality of the company’s work. Also, it’s a good idea to check sources such as the Better Business Bureau for any complaints or positive affirmations.

- Property Management Agreement Terms: This document is a legally binding contract that outlines the relationship between you and the property manager. Additionally, it specifies the management team’s responsibilities for the oversight of your property. With so much at stake, read it carefully and make any necessary amendments before signing off.

- Appropriate Insurance: Confirm that the company has adequate general liability insurance, property-casualty insurance, and errors and omissions (E&O) policies. As a landlord and property owner, you, too, may be required to have certain limits of coverage. Keep in mind; this is beneficial added protection for you.

Additional Considerations in Choosing a Property Management Firm

- Tenant Lease Agreement: The lease is a crucial document in the success of your rental experience. It should be clearly written, with all terms laid out from the security deposit to special rules and regulations. Ask potential property managers if a lawyer has reviewed their lease? If not, that may be a red flag, as not all terms might be enforceable.

- Technology: The right software can indicate that a management firm has the tools needed to succeed. Many daily property management tasks are much more streamlined with the aid of technology. Up to date management and accounting software ensures convenience, detailed record-keeping, and peace of mind.

- Management Company’s Vacancy Rate: It is a simple question that can reveal a lot about the effectiveness of a company. Ask what the percentage of vacancies is against the number of properties they manage. Also, inquire about their overall eviction rate. These numbers speak volumes about their ability to market your rental property and find qualified tenants.

- Property Inspection Procedures and Frequency: Choose a company that does, at minimum, annual inspections of the properties they manage. Detailed inspections are crucial to identifying potential maintenance concerns and evaluating tenant damage. Each inspection should include a detailed report and photos.

- Advertising and Tenant Screening: Browse through the company’s current listings and ask yourself, how do they look? Are the ads well-written? Do the photos look professional? These factors will directly affect a listings appeal and, in turn, vacancy time. So, be sure to ask where they advertise in addition to their site and what their process is for tenant screening.

Final Thoughts on Property Management Company Fees

Hiring a property manager can alleviate all kinds of headaches, but it is essential to hire the right fit for your goals. The right experience, technology, customer service, and fair property management company fee structure all contribute to how comfortable you will be with your choice. So, carefully consider the criteria above in your search, and if you want a property management expert in your area, look no further than Bay Property Management Group. We offer property management services in Washington, DC, Maryland and Pennsylvania, and provide quality service to help increase your ROI by maximizing rental rates while reducing costs with low management fees and no hidden costs!

Examples of Miscellaneous Fees Paid to Other Parties

Examples of Miscellaneous Fees Paid to Other Parties How Can You Prepare for Unexpected Maintenance Costs?

How Can You Prepare for Unexpected Maintenance Costs?