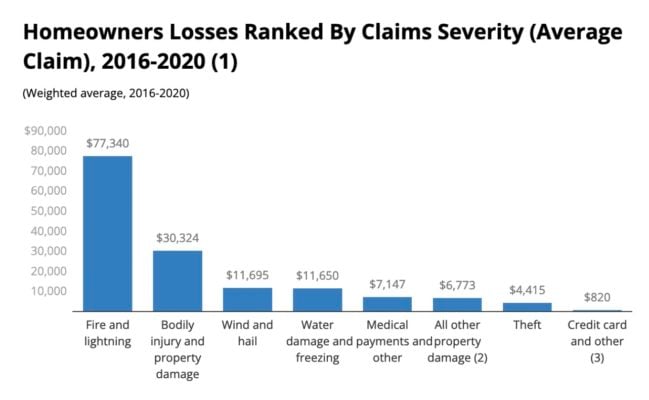

Insurance payments are inevitable expenses for any landlord, but many can be overwhelmed by the options and available price ranges to choose from. Landlord insurance or rental property insurance can provide rental property owners with broad, general protection. It acts as the landlord’s safety net in the event of property damage, income loss, or other emergencies. Costs associated with property damage caused by fire and lightning can rise to over $77,000 and these costs can cause significant financial strain.

When emergencies occur, landlords rely on the protection of their insurance to prevent financial and mental strain. This is why it is extremely important to find an insurance company that is reliable and trustworthy. Here is how landlords can choose the right insurance partner and ensure they receive the best coverage for their needs.

How to Choose the Best Landlord Insurance Company

Research and evaluate the insurance company’s history and financial strength

The decision-making process for insurance should be as thorough as for any other big ticket items. Before making a final decision on the insurance partner and policies, landlords should research all the options available to them. This helps assure landlords that a company is in the right position to pay out claims, provide extensive customer support—and that they’ll be in business for the entire period of the lease. Customers can do this by looking at reviews from past customers and studying the payout history of an insurance company. Good resources for this are AM Best ratings and the Better Business Bureau.

Compare the coverage that each company and policy provides

Compare the coverage that each company and policy provides

Once landlords have a shortlist of viable insurance company partners, they should study the policies and coverage options. Landlords should evaluate policies using a wide variety of metrics such as price, deductibles, covered items, and potential payout amounts. The importance that a landlord gives to each of these metrics will depend heavily on their unique needs and preferences.

Consider the ease with which regular administrative tasks can be done

Finally, landlords should always consider the ease of doing business with each of these partners. Each landlord has unique preferences for how to make payments to the insurance company, how to submit a claim, and how a payout is collected. For instance, younger customers might want to make sure that their insurance partner of choice offers online payments. Others deem a simplified and efficient claim process as a key deciding factor.

Tips on Getting the Best Landlord Insurance Quote

Keep your rental property well maintained

The state of your rental property directly affects the likelihood of property damage and avoidable mishaps. This, in turn, directly affects premium prices. All insurance companies determine premiums based on a fixed set of factors including the state of the property in question. Well-maintained properties are also less likely to need regular payouts from insurance companies. This helps rental property owners build a history of trustworthiness. Then, they can use that to negotiate premium prices across multiple properties.

Agree to higher deductibles to pay lower premiums

Agree to higher deductibles to pay lower premiums

Rental property owners can also use deductibles to reduce the amount they have to pay in premiums. Deductibles are the out-of-pocket payments a policyholder agrees to pay before the insurance company makes a payout, and they allow landlords to share the financial responsibility of a mishap with their insurance partner. This also allows landlords to ensure that they have enough coverage despite low per occurrence limits. If a deductible is decided to be $1,000 and a claim is valued at $10,000, the landlord receives a payout of $9,000. While this seems counterproductive, landlords who can afford to pay for unexpected financial losses might want to take a higher financial burden in exchange for reduced regular premium payments.

Purchase your insurance policies in a bundle

Most landlords and property owners rent out multiple properties. This presents them with the opportunity to receive more competitive rates for holding multiple policies and/or lines of business with the same carrier. Even landlords with a single property can bundle multiple policies for different coverage areas and use that to negotiate a better rate. In addition to the price benefits that bundling policies can confer, landlords can also use this opportunity to add more extensive coverage to their rental properties.

Ensure that your tenants have renters insurance

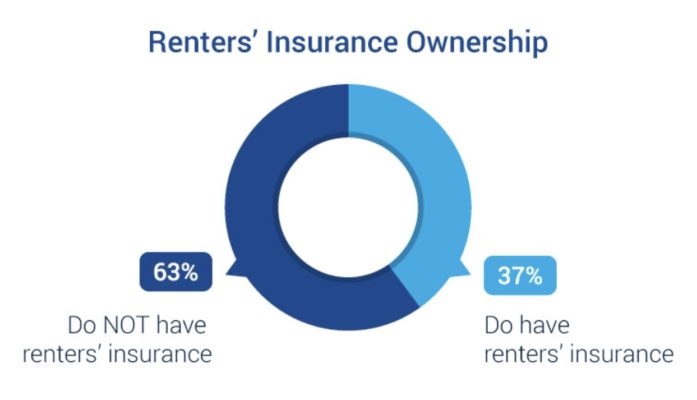

Another way that landlords can increase their ability to negotiate better insurance prices is by reducing the amount of coverage they need. During the course of a lease, tenants have as much stake in the financial losses that mishaps can cause as landlords. Despite the importance of extensive insurance coverage, recent research found that 63% of American tenants still do not have renters insurance. As demand for rental property increases, landlords can choose tenants that are more responsible and trustworthy. This can then be reinforced by requiring renters insurance from every tenant.

Discuss discounts and referral programs with your insurance partner

Even after landlords decide on their insurance partner, they must still assess the policies available to them. Insurance companies often offer a set of discounts for specific customer bases. These discounts can sometimes apply automatically. However, take note of how these discounts can help landlords take a more proactive approach when negotiating for price cuts. Insurance companies can offer discounts for customers who belong to certain organizations or associations, purchase policies in bundles, or have been loyal customers for a long period of time.

Landlords must always ensure that they have adequate coverage across all their rental properties. Income loss, property damage, and other mishaps can severely impact cash flow. Thus, putting a major dent in rental income if the right policies are not in place. With the right insurance partner, landlords can breathe easy knowing that their most valuable assets have the necessary protection.

About the Author

About the Author

Mike Bang is Head of Growth at Azibo, the one-stop-shop financial services platform for rental properties, providing a world-class platform for rent collection, banking, lending, insurance, and more.

Please note that Mike is not a licensed insurance professional and is not providing professional advice on insurance. Readers must contact a licensed insurance agent or company to obtain quotes, advice, and guidance with respect to any insurance matter.

Compare the coverage that each company and policy provides

Compare the coverage that each company and policy provides Agree to higher deductibles to pay lower premiums

Agree to higher deductibles to pay lower premiums About the Author

About the Author