However, rental property investing is a decision that has the potential to reap some incredible benefits.

That is, as long as the real estate investment you’re making is one based on knowledge, and is not something you’re blindly going into.

Knowing as much as possible ahead of time about the rental property you’re looking into, and your options as an investor is the position you want to be in before shelling out some serious money.

And we at Bay Property Management Group are here to help you gain the knowledge you need to make the best decision for your rental property portfolio.

We hunted through real-life rental property listings and came upon one that gives us the perfect opportunity to fill you in on what you need to know before investing in a property such as this.

Keep reading to find out why the property we have chosen is, from an investor’s perspective, is a solid rental property investment.

Finding The Perfect Rental Property To Invest In

The Area

The house we chose is in the neighborhood of Brewerytown which, according to the Philly Voice, is the best neighborhood in all of Philadelphia. What was once somewhat run-down “North Philly” has transformed into a highly popular area with great eats, beautiful architecture, a rich history, and more.

The roots run deep here in Brewerytown, but it has also become a place of innovation, where new ideas for expansion and improvement of life are blossoming.

Here are a few highlights of the neighborhood where this rental property is located:

Culture

Here you’ve got the Art Museum and the Philadelphia Zoo within walking distance, along with many more Philly arts and culture highlights, thus making Brewerytown a place people want to be living.

Retail

Though there are already some great stores in this area, new ones keep coming. The shopping experience here is getting better and better every day, and it’s not long before this becomes a shopping hot spot.

Food

The options for eats here are a foodie’s dream. Philly favorite Angelino’s serves up top-notch Italian Cuisine, and classic spots such as Blue Jay Restaurant and Butter’s Soul Food are right in the neighborhood.

Transportation

Dubbed “one of the most accessible sections of the city,” Center City is a 15-minute car ride away. You’ve also got SEPTA running all around you, and are just five minutes from I-76.

Zillow estimates that home values in this area will increase nearly 7% over the next year, so this clearly is a neighborhood whose potential is continuously on the rise.

The Property

With the popularity of Brewerytown growing consistently, it is a good idea to grab up rental property in this Philadelphia neighborhood while you still can.

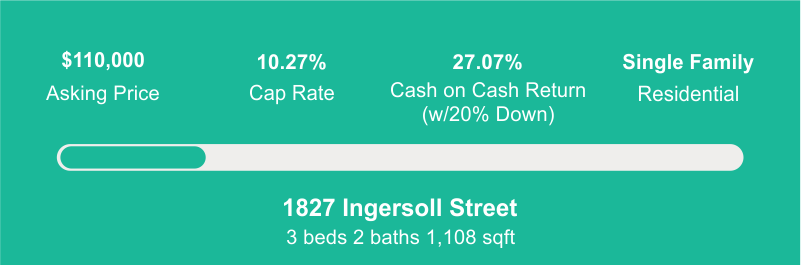

This is especially true if the property is like what we found at 1827 Ingersoll Street. This 1,108 square-foot single family home consists of 3 bedrooms, 1 full bathroom, and 1 half bathroom.

With an asking price of $110,000, there is undoubtedly some money to be made by investing in this property. The purchase price of this home is reasonably low as compared to the amount that you can potentially get for rent.

But, as mentioned above, this is not an investment you want to make unless you have some sound research to back it.

Follow along with the in-depth analysis of 1827 Ingersoll we have put together so that you can see for yourself why this property makes for a sound investment.

Fix Up

One of the first things you want to take a look at when investing in rental property is how much repair the property needs.

The last thing you want is to throw money down on a property you think is ready to turn around to renters, only to find out the place needs some serious upgrades that will cost you a pretty penny.

Instead, before purchasing, do an analysis of what work needs to be done.

For this specific property at 1827 Ingersoll, you would likely be looking at the following upgrades and repairs:

- New carpeting (estimated at an average of $2.25 per square foot for an economy grade)

- A fresh coat of paint (estimated at an average of $1.88 per square foot for the interior)

- Kitchen appliance upgrade (estimated at about $3000 for refrigerator, stove, and range, and dishwasher, plus installation)

These upgrades are based on the pictures shared on Zillow, so you may uncover more when you go to see the property in person.

Here are some other repairs to keep in mind and ask the realtor about when further investigating this house on-site:

- Does the property need a new roof?

- Does the property need new siding?

- What is the condition of the piping? Is it old galvanized piping or is it PVC?

- How is the HVAC system?

- Does the property need a new water heater?

- Any foundation issues or signs of flooding?

- Do any of the kitchens or bathrooms need to be renovated?

This is certainly not an all-inclusive list, but all of the above are questions you want to get the answers to.

Financing

Before you determine that 1827 Ingersoll is the property you want to invest in, now it’s time to take a look at your financing options.

Conventional

While there are a plethora of choices when it comes to financing an investment property, we are going to focus today on a traditional 30 year fixed rate mortgage.

With this financing choice, you will most likely head to a national lender such as Wells Fargo or Bank of America and apply for a loan for the cost of the property. In the case of 1827 Ingersoll, its purchase price is $110,000 which means after negotiating with the seller you can probably get the property for $100,000.

So, for a property that costs $100,000 (based on your income and credit score), you will be looking at putting down 20% on the loan, or $20,000.

Keep in mind that these numbers assume that no significant items need to be addressed such as a new roof, new plumbing, a new HVAC system, etc. If that type of work is indeed necessary for the Philly property, then a 30-year fixed rate loan is likely not the way to go.

Rent

Given the growing popularity of this area, the size of the property, and the updates that you will be doing to bring this Philly property up in value, a competitive rental price for 1827 Ingersoll is $1,450/month.

Monthly Recurring Costs

IF you are looking to get a mortgage and finance this property it will require a typical 20% down, cash out-of-pocket conventional loan on the property at 1827 Ingersoll, your estimated mortgage payment will be $405.00 a month.

This amount is based on a 30-year fixed rate loan at 4.5% which seems a good possibility for a generally well-qualified applicant with solid credit and income history.

In addition to the monthly mortgage payment, you can expect the following costs every month:

Taxes (estimated for 1827 Ingersoll at $82.83/month)

Insurance (estimated at $45.00/month)

Management fee — 8% of rent (estimated at $116.00/month)

Property management companies handle the parts of your investment property you don’t want to have to think about — from tenant screening to maintenance; evictions to turnover, and everything in between.

Thus, with the financing for your new investment at 1827 Ingersoll, you are looking at a total of an estimated monthly recurring cost of around $648.83.

Ongoing Maintenance and Reserves Costs

In addition to the fixed monthly costs you’ll have at your property, you will have other costs that may come up on a less routine basis but that it is prudent to build reserve funds for these future expenses.

What exactly do we mean by that?

Well, you will want to have or to be building a reserve for the following:

Capital Expenses

This category of expenses includes things such as repairing the roof, putting in a new HVAC system, repaving the driveway, siding, kitchen renovation, water heater and much more.

To be safe, we recommend for this property that you set your capital expenses at 5% or $72.50 per month.

Rental Property Maintenance

No matter how well your tenants take care of your property, there are going to be maintenance issues. Thus, you want to set aside some money for when the time does come.

So we suggest that you set aside 5% or $72.50 per month for this.

Vacancy

In an ideal world, your property at 1827 Ingersoll would never be vacant. Unfortunately, that is not the case, so you want to have a stash of extra money for when vacancies do occur.

Again, 5% or $72.50 per month should be enough for this specific neighborhood.

Tenant Turnover Costs

This reserve is one to be kept for things such as the turnover costs you face each time a tenant leaves your property, and a new one comes in. Items that fall under this category include new paint and lock changes.

This can also be estimated at around $50/month for this property.

Delinquency Costs

We hope we get a good stable tenant that pays on time and every month. However, the reality of it is that bad things happen and to be safe we should allow some reserve to accrue to help pad the account in case a tenant loses a job or is unable to pay their rent on time.

We would suggest a 5% monthly reserve should be good – so far this property as with the previous estimates something around $72.50 per month would be an excellent place to start.

Thus, for these calculations, we are going to estimate the total ongoing monthly management reserve account expenses to be $350/month.

Consider an LLC for your Rental Property

Putting your rental property in an LLC is a great way to protect your assets. Let’s say one of your tenants sues you, claiming they got poisoning in your property from exposure to lead paint.

If you have formed an LLC that you have placed your property in, the tenant can only sue you in an attempt to take the assets in the LLC.

If, however, you did not form an LLC, and the property is in your personal name, then your tenant can sue you to try and take any of your assets, including taking money that is in your bank account, garnishing your wages, and more.

Forming an LLC in the state of Pennsylvania is a relatively easy and inexpensive process. Just fill out the appropriate LLC paperwork, and pay $125/year for your LLC.

Totals

Now that we’ve gone into the details and analyzed the costs involved in purchasing 1827 Ingersoll, let’s recap.

Purchasing Price: $100,000

20% down (if going route of conventional 30-year fixed rate loan): $20,000

Estimated Mortgage Payment: $405.00

Taxes: $82.83

Insurance: $45

Management Fee: $116

Reserve for Capital Expenses: $72.50

Reserve for Maintenance: $72.50

Reserve for Vacancy: $72.50

Reserve for Delinquencies: $72.50

Reserve for Turnover Costs: $60

TOTAL MONTHLY EXPENSES, DEBT SERVICE, AND RESERVES: $998.83

If your net rent is $1,450 a month, and your expenses are $998.83 a month, that means:

Estimated Net Operating Income: $451.17

So here are some popular terms to discuss when discussing this deal and just HOW good a deal it might be based on our estimated numbers.

Cash on Cash Return

The numbers you need to know do not stop at your estimated net operating income.

It’s important you take the math further to learn what your cash on cash return would be and how that might compare against both other real estate investments and other investments in general like stock, bond or bank deposits.

In the case of this property at 1827 Ingersoll, your cash on cash return is 27.07%.

What does that mean?

It means that taking into account the cash you actually put into the property ($20,000 down on the loan), you can calculate your return like this:

Estimated Net Operating Income: $451.17/month x 12 months/year = $5,414.04

Take that $5,786.04 in operating income a year (money coming in each year), and divide it by the amount you put down in cash (cash out of your pocket that went into the deal).

$5,414.04 / $20,000 = 27.07% cash on cash return

This shows that you can expect to yield 27.07% on this $20,000 “out of pocket” investment you made to purchase the property.

Cap Rate

This is another number you want to calculate before investing in a rental property — it looks at the investment without financing.

Cap rate is designed to compare similar investments without taking into account the debt service or mortgage payments required if financing the property. This would be a good comparison if you had $100,000 available for investment and were comparing the differences between a potential real estate investment and maybe a 20 year corporate bond.

Cap rate essentially lets you know if you are getting a good deal on the property. It does so by comparing what your return on investment is to how much you paid for the property.

Here’s the breakdown for 1827 Ingersoll:

Estimated Net Operating Income without Debt Service: $856.17/month x 12 months/year = $10,274.04

Take that $10,274.04 in net operating income a year, and divide it by the purchase price of the property ($100,000):

$10,274.04 / $100,000 = 10.27% cap rate

This shows the potential annual interest income you could make compared to the amount of money you paid for the property.

Final Thoughts

As you can see, there is some number crunching involved in purchasing a rental property.

In the case of this specific property at 1827 Ingersoll Street in Philadelphia, we at Bay Property Management Group deem this rental property a good investment.

(Keep in mind that we do not know the status of things such as the roof, the HVAC system, etc., so the information we provided and the numbers we shared here are based on assuming those things are all in good shape.)

If you are interested in investing in this rental property or other rental properties in the Philly area, be sure to reach out to one of our Philadelphia Property Management specialists.

So if you want to try and mess around with your own Google Sheet putting in some of your own property numbers – here is a link to a copy of the spreadsheet we used for this Case Study.

It is set to “Read Only” – but you can go in and make your copy – under File – Make Copy: You can get your copy by clicking HERE.

From the tenant placement process to lease agreement drafting; from rent collection to maintenance, we cover it all so that you can focus your attention on building your rental portfolio.