If you’ve been following the housing market over the past few years, you know that it can be highly unpredictable. Looking back on the past three years, each year has brought new challenges and benefits that most investors couldn’t have predicted. That said, looking into 2023, many investors wonder where the housing market is heading. If you want to know what to expect, check here’s a home price forecast for 2023.

Contents of This Article:

- What Can Buyers and Investors Expect for 2023?

- 2023 Home Price Forecast for the Top 25 US Markets

- Home Price Forecast for 2023: Will Home Prices Drop?

- What’s Going on With Housing Supply and Demand?

- Tips for Investors Looking at Real Estate in 2023

- Protect Your Investment Properties with Comprehensive Management

What Can Buyers and Investors Expect for 2023?

It’s hard to say where the market’s heading for 2023. Experts have mixed thoughts, but most predict less buyer demand, lower home prices, and higher borrowing rates. As we approach the end of 2022, we’ve seen increased mortgage rates and a shortage of supply. That said, many buyers are opting to wait for a more ideal buying situation.

Ultimately, it’s hard to say what will happen over the next year. However, most experts predict increased home prices in most markets in 2023. Additionally, if inflation persists throughout the year, mortgage rates could increase, majorly impacting the housing market.

Some experts predict a recession at the beginning of 2023 due to the state of the housing market. Then, it’s possible for home prices to decrease in 2023. After all, higher mortgage rates may cause a drop in demand, which can slow the growth of home prices. However, most experts expect home values to rise in most markets.

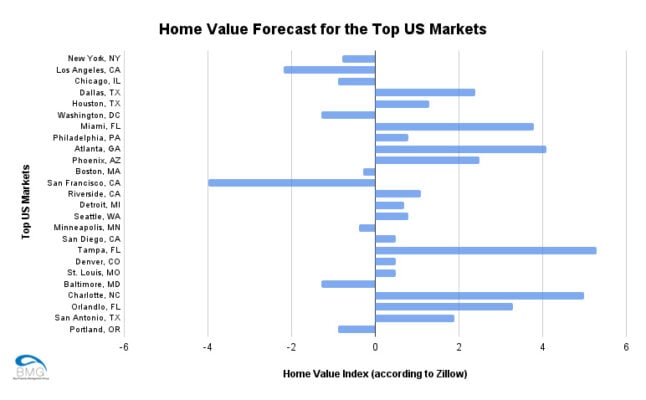

Next, let’s go over the top 25 US markets and their projected year-over-year home value change, according to Zillow’s Home Value Index.

2023 Home Price Forecast for the Top 25 US Markets

According to Zillow’s Home Value Index, it looks like many of the top markets will appreciate year-over-year while others are slowing down. Here’s a look at the top 25 markets in the US and Zillow’s projection of home values through August 2023.

- New York, NY: -0.8

- Los Angeles, CA: -2.2

- Chicago, IL: -0.9

- Dallas, TX: 2.4

- Houston, TX: 1.3

- Washington, DC: -1.3

- Miami, FL: 3.8

- Philadelphia, PA: 0.8

- Atlanta, GA: 4.1

- Phoenix, AZ: 2.5

- Boston, MA: -0.3

- San Francisco, CA: -4.0

- Riverside, CA: 1.1

- Detroit, MI: 0.7

- Seattle, WA: 0.8

- Minneapolis, MN: -0.4

- San Diego, CA: 0.5

- Tampa, FL: 5.3

- Denver, CO: 0.5

- St. Louis, MO: 0.5

- Baltimore, MD: -1.3

- Charlotte, NC: 5.0

- Orlando, FL: 3.3

- San Antonio, TX: 1.9

- Portland, OR: -0.9

As you can tell by the values listed, most markets will see appreciation year-over-year, while others won’t. Among the top markets, Tampa and Miami have some of the highest growth projected. On the other hand, San Francisco and Los Angeles are projected to have a sharp decline in home values.

Now, what does this mean for the future and looking into 2023? The home price forecast suggests that home values will drop in some markets. But what does this mean overall for investors? Read along as we discuss below.

Home Price Forecast for 2023: Will Home Prices Drop?

Many investors wonder if 2023 will be the year that prices will drop. However, it highly depends on the supply and demand of housing.

As most people know, home prices increase when there’s more demand, and prices drop when the demand for housing is met.

Over the past year, we’ve experienced a lack of available homes and increased home prices. The reason prices are so high is that there aren’t enough to meet buyers’ demand. However, as we approach 2023, Fannie Mae predicts that home prices could fall in 2023. Increased mortgage rates are taking a toll on the market, causing prices to decrease slightly. That said, some experts project national home prices to decline by 1.5 percent in 2023.

That said, it’s important to look at supply and demand while determining market prices.

What’s Going on With Housing Supply and Demand?

We all know that supply and demand are huge factors in the housing market. When the demand falls, more people compete to sell their homes, which can naturally lower home prices. However, that doesn’t necessarily indicate a market crash.

After all, prices are declining so slowly that it doesn’t look like any major changes are about to happen. So, for those wondering what will happen with the housing supply and demand in 2023, the answer is: it’s hard to predict.

Furthermore, the answer may differ depending on what market you’re looking at. For instance, some markets, like San Francisco, CA, are experiencing major declines in home values and more people leaving the area. While on the other hand, markets like Knoxville, TN, are seeing major increases in values, with more people looking for real estate.

That said, if you’re looking to invest in real estate within the next year, let’s go over some tips to keep in mind throughout the process.

Tips for Investors Looking at Real Estate in 2023

If you’re looking to invest within the next year, there are a few tips to keep in mind. Follow these steps if you want to get the most from your investment.

- Stay Up to Date With the Housing Market- If you’re investing in real estate, it’s crucial to have knowledge of the market to determine whether it’s a good time to buy or not. Additionally, it’s good to stay up to date with home prices, mortgage rates, and other market factors while investing in real estate.

- Consider Short-Term Rental Properties- If you want a profitable investment, consider short-term rental properties or vacation rentals. Short-term and vacation rentals are estimated to grow to provide higher rental income than most traditional properties.

- Estimate the Profitability of Your Investment- Before purchasing any property, you’ll want to estimate the profitability. Determine what type of return you’re looking for and calculate the monthly cash flow and cap rate.

- Stick to Your Budget- No matter how good a property may seem, if it’s outside your budget, it’s probably not wise to invest. Instead, keep looking until you find a property that fits your needs and your budget. After all, the goal is to earn a favorable return on your investment.

- Hire Rental Property Management- Investing in more rental properties means more work and responsibility. As such, you may want to look into property management companies in Washington, DC, to help your business run smoothly.

Protect Your Investment Properties with Comprehensive Management

It’s hard to predict what’ll happen with the housing market within the next year. The home price forecast for 2023 suggests that it’ll continue to be difficult to find reasonable homes at good prices. As such, if you’re planning on investing next year, you’ll want to be on the lookout for the right home price and mortgage rate.

Additionally, you’ll want to be on top of things like rental property management. After all, if you’re expanding your rental business with another property, you’ll need to spend more time speaking with tenants, performing maintenance, and signing documentation. That said, if you need help managing each of your rental properties, consider hiring comprehensive property management.

Bay Property Management Group offers full-service management for busy landlords, whether you own one property or 100. So, if you own rentals in Baltimore, Philadelphia, Northern Virginia, and Washington, DC, contact BMG today.