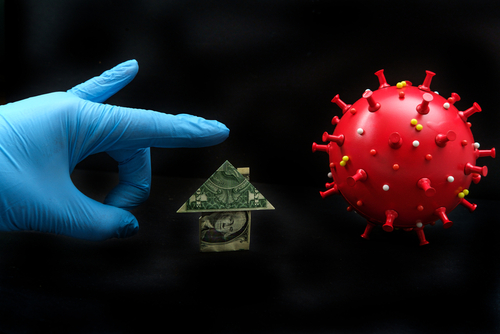

Are you a landlord wondering, “Can I evict my tenants during COVID-19?” COVID-19 is causing high unemployment rates all over the country, which are leading to rent strikes, late rent payments, non-payments of rent, and non-payments of other bills like utilities. As a landlord or property manager in York, PA, you may be wondering about your options with COVID-19 evictions. The short answer is no. However, it’s imperative to understand the current eviction laws, how to navigate rent collection in the current situation, and what it will be like to proceed post-pandemic.

PA Landlord Guidelines for COVID-19 Evictions

Nationally, eviction is not a legal option due to COVID-19. An updated law states that no evictions are allowed until after April 30th, 2020. If conditions get worse or fail to improve, the timeline is likely to be extended. Landlords should remain briefed on the current laws and are legally required to follow them. Failure to do so will result in fines and possibly more severe criminal charges.

There have been several other laws put into place to help tenants be able to pay rent if they have been laid off, furloughed, or had their hours severely cut. These laws include the CARES Act and expanded unemployment benefits. A tenant is still required to pay rent if possible. If not, they must inquire about arrangements and policies their landlords have in place regarding payment options during COVID-19.

The government is working hard to implement assistance programs to allow renters to continue making rent payments. Falling behind on rent during this crisis can have long-term impacts on both renters and landlords. The government is encouraging tenants to utilize these resources to pay rent. Maximizing resources will help avoid the consequences in the near and long-term future. Although there is a moratorium on evictions, tenants will still be required to pay their rent balances post-COVID-19.

Tips to Navigate Rent Collection During COVID-19

Provide your tenants with available resources, create payment plans, and allow for leniency when possible. However, you need to remain clear that they will be held liable for any agreed-upon payment plans.

What COVID-19 Resources are Available for Tenants?

- CARES Act Information: The CARES Act is in place to provide fast financial assistance to those in need due to COVID-19. It includes three new and unique Unemployment Insurance (UI) programs that cover those that may not usually qualify for any program, like gig economy workers, contractors, and self-employed individuals. The act states these individuals will be eligible for an additional $600/week in assistance on top of their regular unemployment benefits. The amount received will be based on an individual’s income for 18-months before lay-off or furlough. This allows those that may be unemployed or losing business due to the pandemic to have a livable income still and be able to make their rent payments.

- Stimulus Check: In addition to the UI resources, Americans will receive stimulus checks via mail or direct deposit. Single tax filers are eligible for up to $1200, and married couples who filed a joint return are eligible for $2400, plus $500 for each qualifying child claimed as a dependent. Individuals with higher incomes will receive varying amounts – check with the IRS to determine stimulus payment amounts for those in higher incomes ranges. Stimulus checks have already begun to be deposited directly into accounts of those that used direct deposit for 2018 or 2019 tax returns. Those that received their tax returns via mailed check will still receive stimulus money, but it will take longer to receive.

What Should Landlords Do to Help Tenants Amid Covid-19?

- Flexibility: During this time, it’s essential to consider other options, depending on your income and what you can afford. For example, some landlords are allowing payment plans that continue even after the lease is up (or require a lease extension). Landlords that can afford to do so may be offering discounts that won’t require repayment in the future.

- Communication: Be clear with your tenants that they need to come to you with their specific circumstances, and you are there to help make a plan to keep them from falling behind. Not only is this in step with the vital spirit of coming together, but it’s ultimately mutually beneficial for you and the tenant.

How Can Landlords Recover Post COVID-19?

You may be wondering about your financial stability as a landlord. Unfortunately, this pandemic doesn’t just impact tenants, but those that are landlords and property managers as well. We have some tips to help you recover financially and continue to thrive as a landlord in York after the pandemic ends:

- Enforce Payment Plans: Try to stick to the original arrangement and avoid further changing the policy. Enforce the payment plans with a signed lease addendum and collect rent as usual.

- Apply for Assistance: Under the CARES Act, you might be eligible as a business owner or self-employed individual to collect compensation. This will help you stay on track during the crisis and hopefully result in less of an impact once the pandemic is finally over.

- Avoid Vacancy: In the end, be sympathetic when you can for tenants in need. Stick to your plans, but remain polite and friendly. Unhappy tenants can lead to vacancies after the pandemic, and vacancies will only cause further financial harm for you as a landlord.

Are you still concerned about COVID-19 evictions? Contact a professional property manager in York, PA for full-service property management services as well as assistance with eviction and rent collection during COVID-19.